Hydrogen Fuel Cell Vehicle Market: Global Industry Analysis (2024–2032)

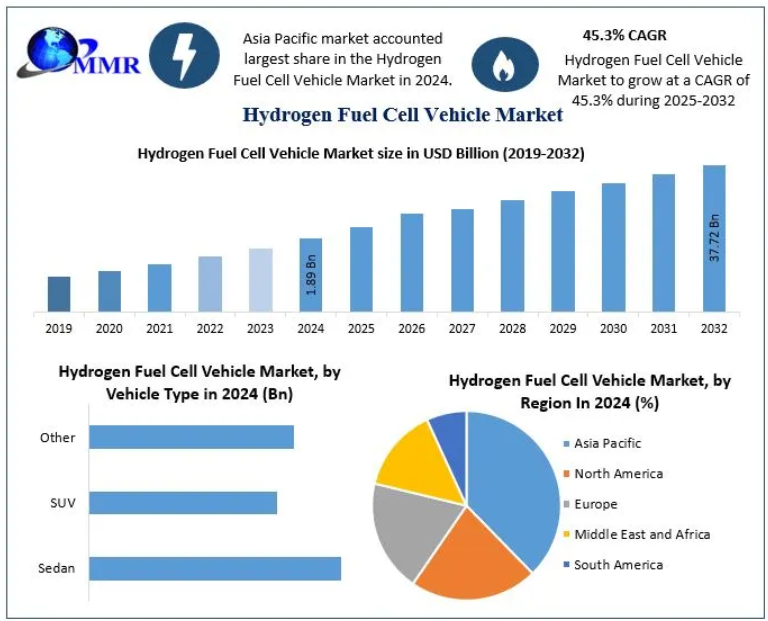

Market Size (2024): USD 1.89 Billion

Forecast (2032): USD 37.72 Billion

CAGR (2025–2032): 45.3%

Overview

The Hydrogen Fuel Cell Vehicle (HFCV) Market is entering a transformative growth phase, driven by rapid advancements in clean energy technologies and global commitments to carbon neutrality. HFCVs generate electricity through an electrochemical reaction between hydrogen and oxygen, producing only water vapour as exhaust. This positions them as a key zero-emission mobility solution—especially for regions investing heavily in hydrogen infrastructure.

Despite its early-stage adoption—with around 10,000 HFCVs on the road globally—the sector is gaining strong momentum as leading automakers such as Toyota, Hyundai, Honda, and Mercedes-Benz accelerate commercial deployment. Governments worldwide are introducing incentives, funding programs, and policy frameworks to advance hydrogen mobility and build refuelling networks.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/184548/

Market Growth Drivers & Opportunities

- Rise of Public–Private Partnerships

Collaborations between governments, research institutions, and private companies are proving critical for scaling hydrogen ecosystems. Programs such as:

- Fuel Cells and Hydrogen Joint Undertaking (EU)

- Clean Hydrogen Alliance (EU)

- California Fuel Cell Partnership (US)

- Australia’s National Hydrogen Strategy (AU)

These initiatives help fund R&D, reduce deployment risks, support refuelling infrastructure, and transition pilot projects into commercially viable markets.

- Increasing Role of Hydrogen in Hard-to-Abate Sectors

Hydrogen is becoming indispensable for industries where battery electrification is insufficient. These include:

- Steel production

- Cement manufacturing

- Heavy-duty transportation

- Marine and aviation

- Mining and rail

Commercial vehicles alone are expected to account for nearly 95% of hydrogen demand in mobility by 2035. Europe may see 850,000 hydrogen trucks on the road, requiring thousands of hydrogen refuelling stations.

- Government Policy Momentum

More than 10 countries—including Japan, Germany, Australia, Chile, and South Korea—have announced national hydrogen strategies, with another wave preparing similar plans. These strategies include massive investments in green hydrogen production, electrolyzer capacity, and hydrogen logistics networks.

In India, schemes like FAME II, National Hydrogen Mission, and PLI programs are preparing the groundwork for green hydrogen adoption and large-scale EV manufacturing.

- Ambitious Cost Reduction Targets

The global hydrogen industry is working to reduce production costs to USD 2/kg, which would make hydrogen fuel competitive with gasoline and diesel. Increasing renewable energy capacity and electrolyzer scale-up are expected to bring significant cost improvements over the next decade.

Market Challenges

High Fuel Costs and Limited Infrastructure

Hydrogen currently costs USD 10–17/kg in regions like California—much higher than electricity for battery EVs. A full refuel typically costs USD 60–70, limiting adoption.

To offset this, automakers offer incentives:

- Toyota Mirai: Up to USD 15,000 in complimentary fuel

- Hyundai Nexo: Free fuel for three years (leasing) or up to six years (ownership)

However, after incentive periods, end-users face higher running costs until economies of scale reduce fuel pricing.

Technology Overview

Proton Exchange Membrane (PEM) Fuel Cells

PEM fuel cells dominate the market due to:

- High power density

- Fast refuelling times

- Suitability for transportation

Vehicles such as the Hyundai Nexo and Toyota Mirai rely on advanced PEM stacks, offering ranges of 350–400 miles. Growing emphasis on sustainability and lightweight mobility systems is accelerating PEM adoption among automakers.

Phosphoric Acid Fuel Cells (PAFC)

PAFC technology remains limited in automotive applications but plays a role in stationary power and niche markets. However, future design refinements may expand its automotive potential.

Regional Insights

Asia Pacific – Global Leader

Asia Pacific is set to dominate the HFCV market due to strong government support, mature technology ecosystems, and aggressive carbon-neutrality goals.

Japan

- Targets net-zero emissions by 2050

- Hydrogen included in national Green Growth Strategy

- Aims to reduce hydrogen cost from US$1/Nm³ to 20 cents/Nm³ by 2050

- Strong OEM leadership (Toyota, Honda) fuels market expansion

South Korea

- Major investments in hydrogen-powered public transport

- Hyundai leads global fuel cell vehicle production

China

- Ambitious hydrogen industry rollout under energy transition strategies

North America

Growth is driven by California’s hydrogen ecosystem, federal incentives, and commercial vehicle projects. Companies like Plug Power and Nikola are building supply chains for hydrogen trucks.

Europe

Europe has integrated hydrogen deeply into its 2030 and 2050 climate frameworks.

- EU plans 40 GW of electrolyzer capacity by 2032

- Germany developing a national hydrogen network

- Massive investments across refineries, transport, and industrial sectors

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/184548/

Market Segmentation

By Vehicle Type

- Sedan

- SUV

- Others

By Technology

- Proton Exchange Membrane (PEM) Fuel Cell

- Phosphoric Acid Fuel Cell

By Range

- 0–250 Miles

- 251–500 Miles

- Above 500 Miles

Key Players

North America

- General Motors

- Ballard Power Systems

- Plug Power

- Nikola Corporation

- Cummins

- Bloom Energy

Europe

- Mercedes-Benz

- NEL ASA

- AFC Energy

- Ceres Power

- SFC Energy

- PowerCell Sweden

Asia Pacific

- Honda Motor Company

- Hyundai Motor Company

- Doosan Fuel Cell

- Toshiba ESS

- Horizon Fuel Cell Technologies

Middle East

- Saudi Aramco

- ADNOC

South America

- Engie

- YPFB

Conclusion

The Hydrogen Fuel Cell Vehicle Market is transitioning from a niche segment to a powerful pillar of global clean mobility. With unprecedented government support, rising commercial vehicle demand, rapid cost reductions, and a shift toward net-zero industries, hydrogen is poised to play a transformative role in the future of transportation.

As nations prioritize cleaner energy pathways—especially for heavy-duty mobility—HFCVs will emerge as a critical solution, bridging the gap between zero-emission goals and real-world transportation demands.

More Trending Reports :

Global Cloud Based ITSM Market https://www.maximizemarketresearch.com/market-report/global-cloud-based-itsm-market/29205/

Asia Pacific Enterprise Content Management Market https://www.maximizemarketresearch.com/market-report/asia-pacific-enterprise-content-management-market/7198/

Global Clinical Information System Market https://www.maximizemarketresearch.com/market-report/global-clinical-information-systems-market/25362/

Global Digital Badges Market https://www.maximizemarketresearch.com/market-report/digital-badges-market/12943/

Asia Pacific Life Reinsurance Market https://www.maximizemarketresearch.com/market-report/asia-pacific-life-reinsurance-market/189584/