Third-party logistics (3PL) business has emerged as a mainstay pillar of the global healthcare supply chain. With pharmaceuticals, hospitals, medical devices, and biotech entities increasingly looking for efficiency, compliance, and agility, the 3PL healthcare logistics business is evolving at a breakneck pace. As global demand for cold chain solutions, technology integration, and patient-focused delivery models is growing, healthcare businesses are relying more and more on 3PL providers to tackle their intricate supply chains.

This blog delves into the primary growth strategies, dominant players, and pivotal segments propelling the 3PL healthcare logistics market growth.

Market Snapshot: A Sector on the Rise

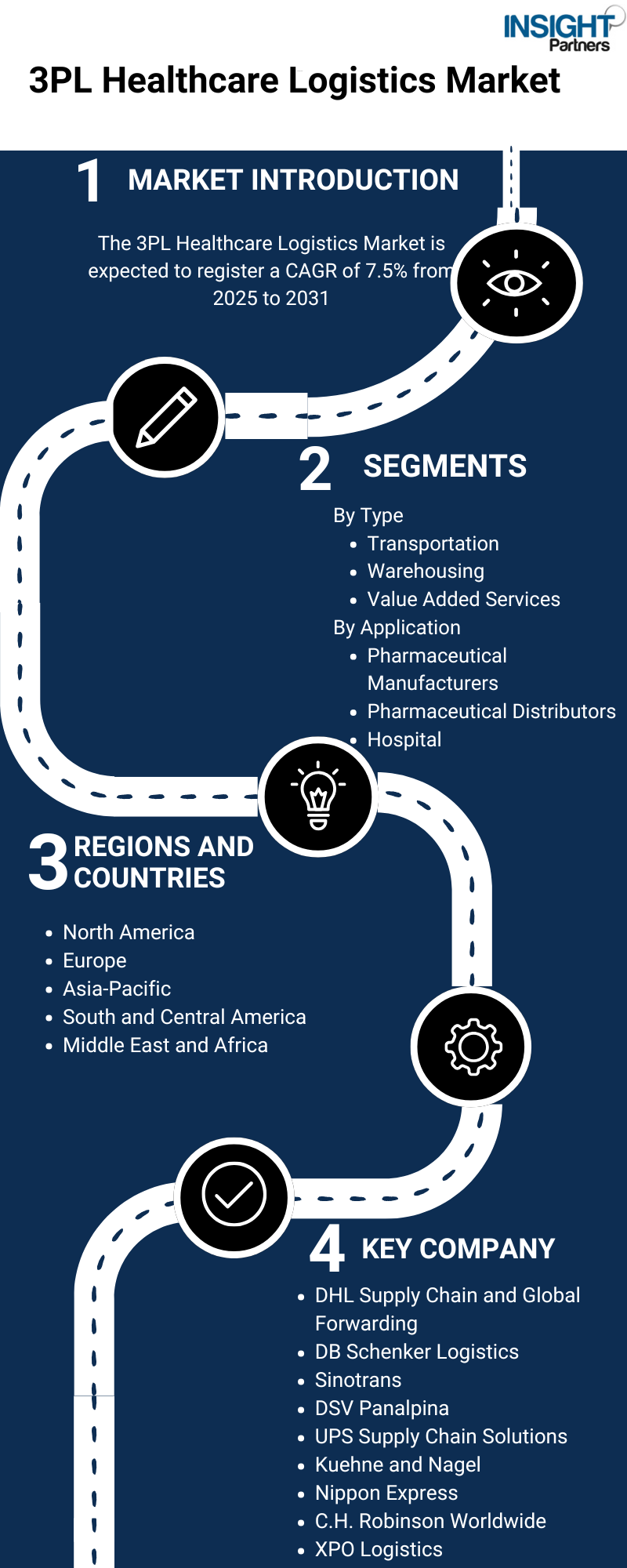

Global 3PL healthcare logistics market was around USD 236.4 billion in 2024 and is estimated to reach over USD 489 billion by 2033, at a CAGR of 7.6%. This high growth is driven by rising demand for cold chain logistics, growth in the biopharmaceutical industry, digitalization of logistics services, and intensified regulatory compliance complexity in healthcare logistics.

The growth of the industry is strongly observed in markets like North America, where the industry leads the market, and Asia Pacific, the fastest-growing market, due to thriving pharmaceutical manufacturing and encouraging government programs in countries like India and China.

Growth Strategies in the 3PL Healthcare Logistics Market

To stay competitive within this changing environment, 3PL players are launching a spectrum of strategic initiatives. The following are the most significant growth strategies seen throughout the industry:

Technology Integration and Digitization

Digitalization is a foundation of contemporary healthcare logistics. 3PL players are increasingly utilizing technologies such as:

Internet of Things (IoT) for real-time temperature and location monitoring,

Blockchain for secure, transparent, and tamper-evident records,

AI and Machine Learning for demand forecasting, route optimization, and risk management,

Warehouse Automation and robotics for enhanced order accuracy and minimizing human error.

By investing in digital platforms, 3PLs can enhance supply chain visibility and predictive analytics for their healthcare customers, critical for the handling of high-value, time-critical products such as biologics and vaccines.

Cold Chain Capabilities Expansion

With the upsurge in biologics, gene therapies, and vaccines, keeping temperature-sensitive logistics intact has become crucial. Providers are increasing investments in cold chain infrastructure—temperature-controlled warehouses, refrigerated vehicles, and validated packaging.

Cold chain logistics already represent more than 40% of the market and are projected to expand tremendously in the next few years, particularly with the ongoing global demand for mRNA vaccines and cellular therapies.

Strategic Partnerships and Mergers & Acquisitions

To increase geographic presence and service capabilities, 3PLs are establishing strategic partnerships and making strategic acquisitions. Examples include:

UPS Healthcare has bought Bomi Group and Andlauer Healthcare to strengthen cold chain logistics and increase presence in Europe and North America.

DHL Supply Chain is continuing to invest in specialized healthcare logistics centers globally.

FedEx has increased its cold chain and healthcare express services through platform investments and strategic partnerships.

These actions allow providers to offer end-to-end services across borders to serve more globalized pharmaceutical supply chains.

4Customized Value-Added Services

In addition to transportation and warehousing, 3PL providers are emphasizing value-added services like:

Repackaging and labeling,

Regulatory assistance and customs clearance,

Clinical trials logistics,

Direct-to-patient (DtP) delivery.

This tailoring maximizes customer satisfaction and enables 3PLs to stand out in a competitive marketplace.

Key Market Segments: What's Driving Growth?

3PL healthcare logistics market is divided on the basis of service types, products handled, and end-users. Each one offers unique opportunities and challenges.

By Service Type

Transportation: The core of 3PL services, this consists of road, air, sea, and rail logistics. It accounts for approximately 45% of the market share.

Warehousing & Distribution: Comprises both ambient and cold storage facilities. This segment is growing because of the rising quantity of temperature-sensitive medicines.

Value-Added Services: The most rapidly growing sub-segment, spurred by last-mile delivery, kitting, and clinical trial logistics demand.

By Product Type

Pharmaceuticals: The products that spearhead the 3PL healthcare logistics market, spurred by generic and branded drug production.

Biopharmaceuticals: The most rapidly growing segment, with a CAGR of over 8%, spurred by the growth in biologics, personalized medicine, and mRNA vaccines.

Medical Devices: Incorporates diagnostic technology, surgery devices, and consumer health devices. This sector is also expanding rapidly, especially with the growing home healthcare.

By End-User

Pharmaceutical and Biotech Companies: Biggest users of 3PL service because they have a huge requirement for compliance and worldwide distribution.

Hospitals and Clinics: Need drugs and equipment to be delivered promptly and reliably.

Online Retailers and Pharmacies: With growing healthcare e-commerce, there is also an increasing demand for trustworthy, last-mile delivery options.

Leading Players in the 3PL Healthcare Logistics Market

The 3PL healthcare logistics market is controlled by a combination of specialist regional players and global leaders. The leading players are:

1. DHL Supply Chain & Global Forwarding

As one of the largest logistics providers worldwide, DHL boasts a specialized healthcare division with temperature-controlled logistics, specialty warehousing, and tailored packaging solutions. They have a robust global network that allows them to maintain compliance and reliability in more than 220 countries.

2. UPS Healthcare

UPS has made significant investments in healthcare logistics with the acquisition of Marken, Bomi Group, and Andlauer. It has over 1 million square feet of GMP- and GDP-compliant facilities worldwide, which specializes in clinical trials, biologics, and precision medicine.

3. FedEx Corporation

FedEx provides specialized solutions such as FedEx Cold Chain Center and Priority Alert for life-critical healthcare shipments. Their worldwide coverage and technology investment in sensor-based tracking make them an ideal vendor for vaccine and biotech distribution.

4. Kuehne + Nagel

This Swiss logistics giant provides a strong healthcare vertical, comprising warehousing, customs, and multimodal transportation. Their KN PharmaChain solution provides full GDP and other healthcare compliance.

5. Cardinal Health

Majorly North America-centered, Cardinal Health offers integrated healthcare supply chain solutions, particularly to hospitals, pharmacies, and outpatient clinics.

The other key players in the industry are CEVA Logistics, DB Schenker, SF Express (China), Owens & Minor, and Agility.

Challenges Ahead

Notwithstanding the positive trend, the market has several challenges:

Regulatory Complexity: Adherence to different international regulations (such as GDP, FDA, EMA standards) is resource-scarce.

Infrastructure Lapses: In developing economies, deficiencies in cold chain infrastructure can hinder growth.

Logistics Disruptions: Geopolitical tensions, pandemics, and natural disasters have the potential to disrupt logistics activities.

3PLs need to create resilience through diversified networks, adaptive risk management, and investment in adaptive infrastructure.

Final Thoughts

The 3PL healthcare logistics industry is not only expanding—it's changing. As the healthcare industry becomes increasingly international, data-driven, and patient-focused, logistics companies are shifting from being simple transporters to supply chain strategic partners.

Conclusion :

The 3PL healthcare logistics market is no longer just a support function—it has become a strategic enabler of global healthcare delivery. As the sector continues to evolve, the role of 3PL providers will expand beyond transportation and warehousing to encompass end-to-end visibility, regulatory compliance, real-time tracking, and patient-centered service models.

About The Insight Partners

The Insight Partners is a leading provider of syndicated research, customized research, and consulting services. Our reports combine quantitative forecasting and trend analysis to offer forward-looking insights for decision-makers. With a client-first approach, we deliver actionable intelligence and strategic guidance across various industries.

For Reference - https://pin.it/2XdloZE43

Get Sample Report- https://www.theinsightpartners.com/sample/TIPRE00024469