The competitive landscape of the Photogrammetry Software Market Share is a dynamic and concentrated arena, where a handful of established technology giants and specialized software firms command a significant portion of the global revenue. Industry leaders such as Autodesk (with its ReCap and Fusion 360 products), Trimble Inc. (with Trimble Inpho and eCognition), and Hexagon AB (Leica Geosystems) hold substantial market share, primarily due to their deep-rooted presence in the surveying, engineering, and construction industries. These companies offer comprehensive, end-to-end solutions that integrate photogrammetry into broader workflows like Building Information Modeling (BIM) and Geographic Information Systems (GIS). Their market dominance is reinforced by extensive global distribution networks, strong brand recognition, and large enterprise contracts that create a high degree of customer loyalty and ecosystem lock-in. They continuously invest in research and development and frequently engage in strategic acquisitions of smaller, innovative firms to absorb new technologies and expand their feature sets, thereby solidifying their control over the high-end, professional segment of the market where precision, reliability, and robust support are paramount considerations for customers.

While the titans of the industry control a large slice of the market, a significant share is also held by highly specialized and innovative companies that have built their reputation specifically on the quality of their photogrammetry engines. Agisoft Metashape and Pix4D (part of Parrot Group) are prime examples of such players, having captured a substantial market share, particularly within the professional drone mapping and surveying communities. These companies are renowned for the accuracy of their algorithms, their intuitive user interfaces, and their focus on a specific set of workflows, from aerial triangulation to thermal mapping. Their success demonstrates that market share is not solely determined by the size of the parent company but also by the quality of the core technology and a deep understanding of the end-user's needs. The rise of cloud-based processing platforms, such as Propeller Aero and DroneDeploy, is also reshaping the distribution of market share. These Software-as-a-Service (SaaS) providers target specific industries like construction and mining, offering streamlined, automated workflows that abstract away the complexity of traditional desktop software, making photogrammetry accessible to users without specialized training and capturing a growing share of the market through their subscription-based models.

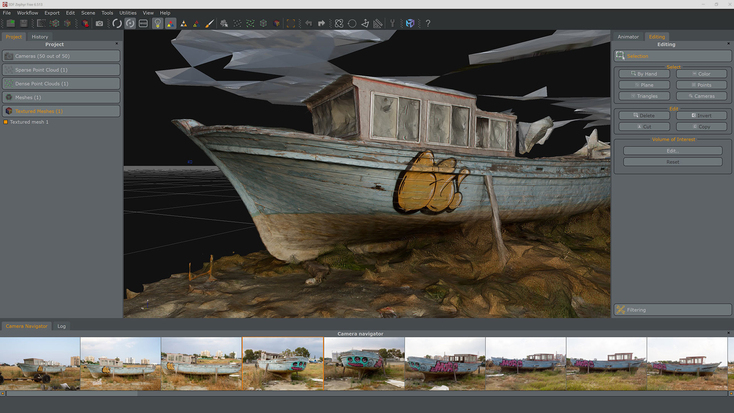

The market share is further fragmented by the presence of powerful open-source solutions and niche players catering to specific verticals. Open-source tools like MicMac and OpenDroneMap, while not contributing directly to revenue-based market share, hold a significant "mindshare" within the academic and research communities and are used by some commercial entities to build custom solutions, influencing the competitive dynamics by providing a free alternative to commercial software. In the entertainment and gaming vertical, companies like Capturing Reality (creator of RealityCapture, now part of Epic Games) have carved out a significant share by offering software optimized for creating hyper-realistic 3D assets from photos, a critical need for modern video games and visual effects. The strategic acquisition of Capturing Reality by Epic Games highlights a key strategy for gaining market share: integrating best-in-class photogrammetry technology directly into a larger content creation ecosystem (Unreal Engine), making it readily available to millions of developers. This complex interplay between large, integrated providers, specialized best-of-breed vendors, SaaS platforms, and niche specialists defines the competitive struggle for market share in this rapidly evolving field.