September 30, 2025 | [City, Country] – The global Resistance Bands Market is projected to reach USD 881.28 million by 2028 , growing from USD 677.26 million in 2022 , at a compound annual growth rate (CAGR) of 4.5% , according to a new market analysis report titled "Resistance Bands Market Forecast to 2028 – COVID-19 Impact and Global Analysis by Type and Distribution Channel."

The comprehensive report, which examines market dynamics across product types— Pull-Up Bands, Tube Bands, Therapy Bands, and Others —and distribution channels such as Supermarkets & Hypermarkets, Specialty Stores, Online Retail, and Others , highlights a strong rebound and continued expansion in the post-pandemic fitness equipment industry.

Pandemic Sparked Permanent Shift Toward Home Fitness

The COVID-19 pandemic has proven to be a pivotal moment for the global fitness landscape. With gyms closed and social distancing mandates in place, consumers turned to home workouts in record numbers. Resistance bands quickly gained traction as a convenient, affordable, and versatile fitness solution suitable for all fitness levels.

“COVID-19 acted as a catalyst for long-term changes in consumer behavior,” said [Spokesperson Name], [Title] at [Company or Research Organization Name]. “Even as gyms have reopened, consumers have maintained hybrid fitness habits—combining traditional workouts with at-home and digital fitness options. This sustained demand continues to propel the resistance bands market forward.”

Market Segmentation Insights

By Type:

-

Pull-Up Bands: Designed for bodyweight exercises, these bands have gained popularity among strength training enthusiasts and gym-goers for assisted pull-ups and full-body workouts.

-

Tube Bands: Equipped with handles and attachments, tube bands offer full-body resistance training and remain a favorite among personal trainers and fitness programs.

-

Therapy Bands: Used in physiotherapy and rehabilitation, therapy bands have become essential tools for hospitals, clinics, and home recovery programs, especially with growing aging populations worldwide.

-

Others: This segment includes loop bands, mini bands, and specialized products used in Pilates, CrossFit, and sport-specific training routines.

By Distribution Channel:

-

Supermarkets & Hypermarkets: These large retail formats continue to be strong channels for casual shoppers seeking fitness products at affordable prices.

-

Specialty Stores: Sports and fitness-focused retail outlets offer a curated selection of resistance bands, often accompanied by expert advice and bundled fitness solutions.

-

Online Retail: E-commerce continues to drive the majority of sales, thanks to convenience, extensive product variety, customer reviews, and influencer-driven marketing.

-

Others: This category includes direct-to-consumer (DTC) brands, medical supply distributors, and fitness studios selling branded gear.

Key Market Drivers

-

Increased Awareness of Health & Wellness

Across all demographics, consumers are prioritizing physical fitness, driving demand for simple and effective training tools. Resistance bands are ideal for beginners and advanced users alike. -

Growth of the At-Home and Hybrid Fitness Models

Even post-COVID, home workouts remain popular. Many consumers have adopted a hybrid model that includes both gym memberships and home fitness routines, reinforcing demand for portable equipment like resistance bands. -

Aging Population and Rehabilitation Needs

With an aging global population and rising incidence of musculoskeletal disorders, physical therapy tools—particularly therapy bands—are seeing increased use in clinical and home settings. -

Affordability and Accessibility

Resistance bands are among the most cost-effective fitness tools on the market, offering excellent value for a wide range of exercises, making them accessible across income groups and regions.

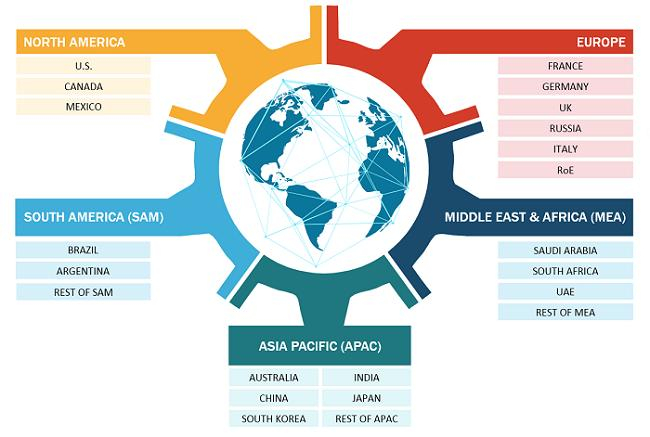

Regional Trends

-

North America holds a significant share of the global market, led by rising health consciousness, high fitness club memberships, and strong e-commerce penetration.

-

Europe shows steady growth, particularly in Western markets where wellness culture is strong.

-

Asia-Pacific is the fastest-growing region, with expanding middle-class populations, rising disposable incomes, and increasing adoption of digital fitness platforms in countries like China, India, and Japan.

-

Latin America and Middle East & Africa are emerging markets where urbanization and digital fitness trends are opening new avenues for resistance band sales.

Competitive Landscape

The resistance bands market is highly competitive and fragmented, with key players focusing on product innovation, e-commerce expansion, and influencer-driven brand building.

Notable companies operating in the global resistance bands market include:

-

TheraBand

-

Fit Simplify

-

Bodylastics

-

Decathlon

-

WODFitters

-

Perform Better

-

SPRI Products

-

GoFit

-

Black Mountain Products

These companies are investing in the development of eco-friendly materials, smart bands with app integration, and bundled kits that include instructional content to enhance customer experience and loyalty.

Technological Innovations on the Horizon

Future developments in the resistance bands market are expected to be driven by the integration of smart technology and wearable sensors, allowing users to track resistance levels, form, and progress through connected apps. Moreover, AI-powered virtual coaching and augmented reality (AR) fitness training platforms are creating new engagement opportunities for tech-savvy consumers.

In addition, sustainable and biodegradable materials are gaining traction among environmentally conscious buyers, prompting brands to rethink packaging, product design, and sourcing practices.

Strategic Recommendations

For businesses and stakeholders looking to capitalize on market growth, the following strategies are recommended:

-

Expand E-commerce Channels: Invest in mobile-friendly websites, optimize product listings on marketplaces, and partner with fitness influencers.

-

Diversify Product Portfolios: Offer bundles, smart fitness tools, and accessories that add value to resistance band purchases.

-

Invest in Health Partnerships: Collaborate with physiotherapists, wellness coaches, and healthcare providers to promote therapy bands and rehabilitation products.

-

Prioritize Sustainability: Align product development with consumer expectations for ethical and eco-friendly fitness gear.

Conclusion

The resistance bands market is no longer a niche segment—it has become a cornerstone of the modern fitness industry. Driven by the lasting effects of the COVID-19 pandemic, shifts in consumer behavior, and growing demand for accessible health solutions, resistance bands are poised for continued growth well into the next decade.

With global market revenues expected to reach USD 881.28 million by 2028 , stakeholders across fitness, healthcare, retail, and tech industries have significant opportunities to innovate and lead in this dynamic sector.