The global forklift battery market , valued at USD 5.94 billion in 2024 , is expected to grow at a compound annual growth rate (CAGR) of 6.6% and reach USD 9.23 billion by 2031 , according to a newly published market forecast report. This growth is driven by the global transition toward electric-powered material handling equipment, rapid advancements in battery technology, and the boom in e-commerce logistics and warehousing.

The comprehensive report titled “Forklift Battery Market Size and Forecast (2021–2031): Global and Regional Share, Trend, and Growth Opportunity Analysis” provides an in-depth analysis of the market, segmented by battery type, capacity, application, and geography.

Key Drivers: Electrification, Sustainability, and E-Commerce Growth

Forklift batteries play a critical role in powering electric forklifts, which are becoming the preferred choice in logistics, manufacturing, and retail operations worldwide. As organizations seek to meet carbon-neutral goals and enhance efficiency in operations, the demand for reliable, cost-effective, and sustainable battery technologies is rapidly increasing.

“The shift from internal combustion engine (ICE) forklifts to electric alternatives is one of the most significant trends shaping the industrial equipment market today,” said [Spokesperson Name], [Title], at [Company/Research Firm Name]. “This transition is not only environmentally driven but also backed by the clear operational advantages of electric forklifts, including reduced maintenance and lower total cost of ownership.”

Segment Analysis: Lithium-Ion Technology Leading the Charge

By Type:

-

Lithium-Ion Batteries

-

Lead-Acid Batteries

-

Others (including Nickel-Cadmium and Gel batteries)

Lithium-ion batteries are emerging as the dominant technology, capturing an increasing share of the global market. These batteries offer numerous advantages, including:

-

Faster charging times

-

Higher energy density

-

Longer lifecycle

-

Reduced maintenance

While lead-acid batteries continue to serve budget-conscious segments, their market share is expected to gradually decline due to growing awareness of lifecycle costs and environmental concerns.

By Capacity: Tailoring Power for Diverse Needs

The report categorizes forklift batteries by their ampere-hour (Ahr) capacity into:

-

0–600 Ahr

-

600–1200 Ahr

-

Above 1200 Ahr

Each capacity range serves different use cases:

-

0–600 Ahr: Suitable for retail and light warehouse operations.

-

600–1200 Ahr: Popular in general manufacturing and logistics sectors.

-

Above 1200 Ahr: Used in heavy-duty industrial applications, where performance and endurance are critical.

By Application: Warehousing and Logistics Leading Demand

The forklift battery market is segmented by application into:

-

Manufacturing

-

Construction

-

Warehouse and Logistics

-

Automotive

-

Retail and Wholesale Stores

-

Others

The warehouse and logistics segment represents the largest and fastest-growing application segment, driven by:

-

The expansion of global supply chains

-

Growth in e-commerce and same-day delivery services

-

Investments in smart warehouses and automation

Meanwhile, manufacturing and automotive sectors continue to adopt battery-powered forklifts as part of broader sustainability initiatives.

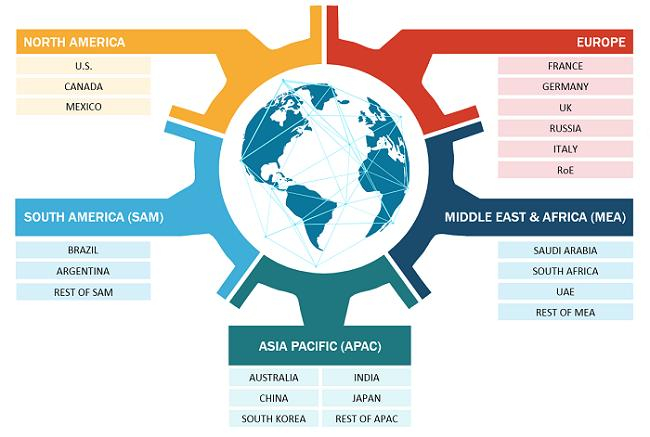

By Geography: Asia-Pacific Leads, North America and Europe Show Strong Momentum

Asia-Pacific (APAC) :

The APAC region leads the global forklift battery market in terms of volume and value, with China, India, and Japan being key contributors. Industrial growth, government incentives, and the presence of large-scale manufacturing facilities are major drivers.

North America :

The region shows strong adoption of lithium-ion technology, driven by environmental regulations and a high rate of technological adoption, especially in the United States .

Europe :

European nations are at the forefront of sustainability and electrification trends. Countries like Germany, the UK, and France are seeing rapid replacement of diesel forklifts with electric models.

Middle East & Africa / South America :

While these regions represent smaller shares, they are witnessing increasing investments in infrastructure and logistics, creating growth potential for the future.

Opportunities and Emerging Trends

The report highlights several emerging opportunities and trends shaping the forklift battery market through 2031:

-

Battery-as-a-Service (BaaS) : Subscription-based models are gaining popularity, reducing upfront costs and making lithium-ion solutions more accessible.

-

Battery Management Systems (BMS) : Integration of smart monitoring and management tools enhances battery efficiency and safety.

-

Second-life Applications : Companies are exploring ways to reuse and recycle batteries, reducing waste and creating a circular economy.

-

Fast Charging Infrastructure : Investments in rapid-charging stations will support increased use of electric forklifts in 24/7 operations.

Challenges to Overcome

Despite the optimistic outlook, several challenges persist:

-

High initial cost of lithium-ion battery systems, especially for small enterprises

-

Lack of standardization in charging systems across regions

-

Environmental concerns regarding battery disposal and recycling

However, continued R&D investment and supportive government policies are expected to mitigate these issues over the forecast period.

Industry Outlook

As global supply chains continue to expand and businesses invest in automation and sustainability, the forklift battery market is positioned for steady, long-term growth. Battery manufacturers, OEMs, and service providers who focus on innovation, strategic partnerships, and market-specific solutions will be best positioned to capitalize on this growing opportunity.

About the Report

The report, “Forklift Battery Market Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis ,” offers in-depth insights into key market dynamics, forecasts, and competitive intelligence. It includes data on major manufacturers, regional trends, and technology evolution.