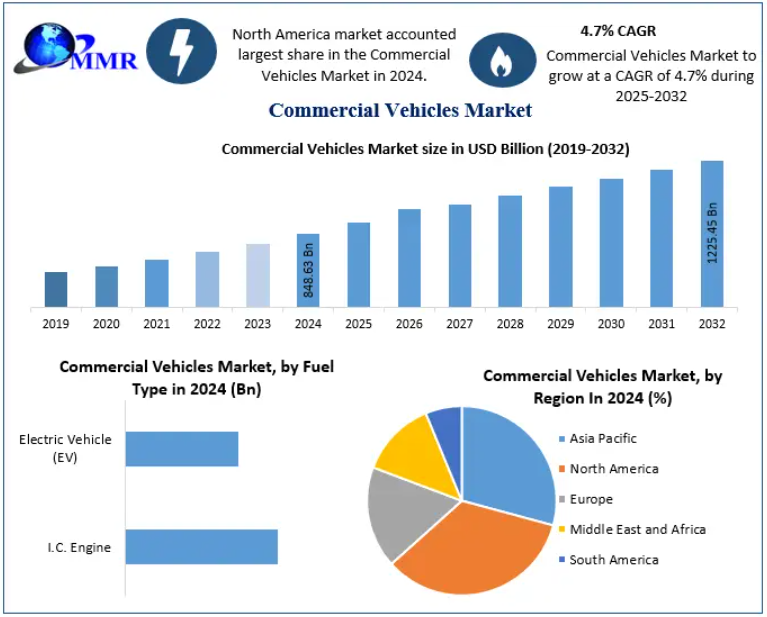

The Global Commercial Vehicles Market was valued at USD 848.63 billion in 2024 , and the industry is projected to expand to USD 1225.45 billion by 2032 , registering a CAGR of 4.7% during the forecast period. This growth is underpinned by rising logistics activities, infrastructure development, and the rapid evolution of electric and connected vehicle technologies worldwide.

Overview: A Market Transforming with Mobility, Logistics, and Electrification

Commercial vehicles form the backbone of modern economies, supporting the transport of goods and passengers across a wide range of industries. This includes:

-

Light commercial vehicles (LCVs)

-

Heavy trucks

-

Vans and pick-up trucks

-

Minibuses, buses, and coaches

-

Specialized transport vehicles used in mining, construction, and industrial operations

The market is witnessing strong demand due to expanding e-commerce, accelerating industrialization in emerging markets, growth in construction activities, and the increasing adoption of sustainable fleet technologies. Governments across the world are enforcing regulations to optimize load management, reduce emissions, and improve road safety — all of which influence the evolution of the commercial vehicle ecosystem.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/112685/

Market Dynamics

1. Fleet Electrification: The Biggest Catalyst for Market Growth

The transition from diesel-powered fleets to electric commercial vehicles (ECVs) is emerging as a central force reshaping the global market. Several factors are accelerating this shift:

Key Drivers

-

Stringent emission norms in the U.S., EU, China, and India

-

Rapid advancements in battery technologies, enabling longer ranges and faster charging

-

Lower total cost of ownership (TCO) due to reduced maintenance and fuel costs

-

Government incentives, EV subsidies, and tax exemptions

-

Expansion of EV charging infrastructure, particularly for fleet depots

Countries are implementing aggressive electrification targets. For instance:

-

The U.S. fleet is expected to operate 15+ million EVs by 2040.

-

European automakers aim to end production of combustion-engine cars by 2030, with buses and commercial fleets transitioning soon after.

-

India sold 716,566 commercial vehicles in 2023, and with freight vehicles responsible for a major share of CO₂ emissions, fleet electrification is becoming essential.

The MaaS (Mobility-as-a-Service) sector is also increasing adoption of electric buses, vans, and cabs to enhance operational efficiency and environmental compliance.

Fleet charging currently accounts for 15% of the EV charging market value, and is expected to grow rapidly as large logistics operators move towards electrification.

2. Technological Advancements: ADAS, IoT, AI, and Predictive Maintenance

The commercial vehicles industry is undergoing a rapid technological overhaul. Major technologies influencing the market include:

Advanced Driver Assistance Systems (ADAS)

-

Adaptive cruise control

-

Lane-keeping assistance

-

Automatic emergency braking

-

Driver fatigue monitoring

These technologies improve safety, reduce accidents, and lower insurance costs.

Telematics and Connectivity

-

Real-time vehicle performance data

-

Route optimization

-

Fuel consumption tracking

-

Driver behavior analysis

IoT & AI Integration

-

Predictive maintenance reduces downtime

-

Smart fleet management improves efficiency

-

AI-based routing enhances delivery speed in logistics

With digital transformation influencing fleet operations globally, commercial vehicles are evolving into intelligent, connected systems, improving productivity across industries.

3. Infrastructure Development Fueling Demand

Massive global investment in infrastructure is a core driver. The expansion of:

-

Roads & highways

-

Bridges & rail networks

-

Airports & seaports

-

Smart city transport systems

…is dramatically increasing the demand for construction vehicles, heavy-duty trucks, material handling trucks, and transit buses.

Emerging nations in Asia, the Middle East, and Africa are leading in infrastructure spending, which ensures sustained demand for commercial vehicles over the coming decade.

4. E-Commerce Growth Driving Delivery Vehicle Sales

The e-commerce boom is reshaping the logistics landscape. Online retail growth has led to increased demand for:

-

Delivery vans

-

Light trucks

-

Last-mile electric vehicles

-

Warehouse transport vehicles

Companies are expanding distribution centers and enhancing last-mile connectivity, leading to robust adoption of small and mid-size commercial vehicles.

China, the U.S., and India—three of the largest e-commerce markets—continue to create strong demand for urban delivery fleets.

5. Challenges: High Operating Costs Remain a Major Restraint

Despite strong growth potential, the commercial vehicles industry faces critical challenges:

-

High fuel costs and volatile diesel prices

-

Expensive maintenance due to heavy-duty usage

-

Elevated insurance premiums

-

High upfront cost of electric commercial vehicles

These factors create barriers for SMEs and fleet operators with limited capital, slowing the adoption of new vehicles in certain markets.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/112685/

Segment Analysis

By Type

1. Light Commercial Vehicles (LCVs) – Largest Share in 2024

LCVs dominate the market due to their:

-

Cost-effectiveness

-

Fuel efficiency

-

Versatility for passenger and cargo transport

-

Strong demand in last-mile delivery

The 3.5–7-ton LCV category in India, Europe, and Southeast Asia forms a significant part of logistics operations.

2. Buses & Coaches – Expected CAGR of 3.1% (2025–2032)

Demand is influenced by:

-

Electrification of public transport

-

Growth in tourism

-

Healthcare mobility needs

-

Urban transit system expansion

3. Heavy Trucks

Used extensively in:

-

Agriculture

-

Mining

-

Construction

-

Freight logistics

Key global manufacturers include Tata Motors, Daimler, Scania, Volvo, Ford, Navistar, and Paccar.

By End Use

1. Logistics – Largest Share in 2024

Driven by:

-

E-commerce growth

-

Strengthening of global supply chains

-

Increasing third-party logistics activities

2. Passenger Transportation

Expected to grow at over xx% CAGR , supported by:

-

Higher public transport usage

-

Rising fuel prices reducing personal vehicle ownership

-

Growth in electric buses

Regional Insights

North America – Largest Market in 2024

Growth is driven by:

-

Long-distance freight transport

-

High adoption of advanced safety technologies

-

Strict load and emission regulations

-

Robust multimodal transport infrastructure

The US automotive export industry shipped USD 97 billion worth of vehicles and components to global markets, highlighting the region's strong manufacturing base.

EV Transition

-

30% of new commercial trucks and buses must be zero-emission by 2030

-

100% by 2040

-

Inflation Reduction Act incentives support up to 1.1 million ZEV commercial vehicles by 2030

Asia Pacific – Fastest Growing Market

China, India, Japan, and Southeast Asian economies are driving demand due to:

-

Urbanization

-

Increase in logistics, warehousing, and e-commerce

-

Expanding manufacturing bases

-

Low-cost labor and materials

-

Heavy investment in road infrastructure

Market Segmentation

by Type

Light Commercial Vehicles (LCVs)

Heavy Trucks

Buses & Coaches

by Fuel Type

IC Engine

Electric Vehicle (EV)

by End Use

Industrial

Mining & Construction

Logistics

Passenger Transportation

Others

Key Market Players

North America

-

General Motors

-

GMC

-

Tesla

-

Rivian

-

Ford Motor Company

Europe

-

Daimler

-

AB Volvo

-

Volkswagen AG

-

Bosch Rexroth AG

Asia Pacific

-

Toyota Motor Corporation

-

Mahindra & Mahindra

-

Isuzu Motors

-

Ashok Leyland

-

Golden Dragon

-

Tata Motors

-

Force Motors

-

VE Commercial Vehicles

-

Scania CV India

Conclusion

The Commercial Vehicles Market is entering a transformative phase, characterized by the rise of electric fleets, digitalization of logistics, rapid urbanization, and massive infrastructure investments. While operating costs remain a challenge, the long-term outlook is strongly positive.

By 2032, the industry will be shaped by smarter, cleaner, and highly connected vehicles that support global trade, mobility, and industrial growth.