Business Jet Market: Global Trends, Drivers, and Growth Outlook (2025–2032)

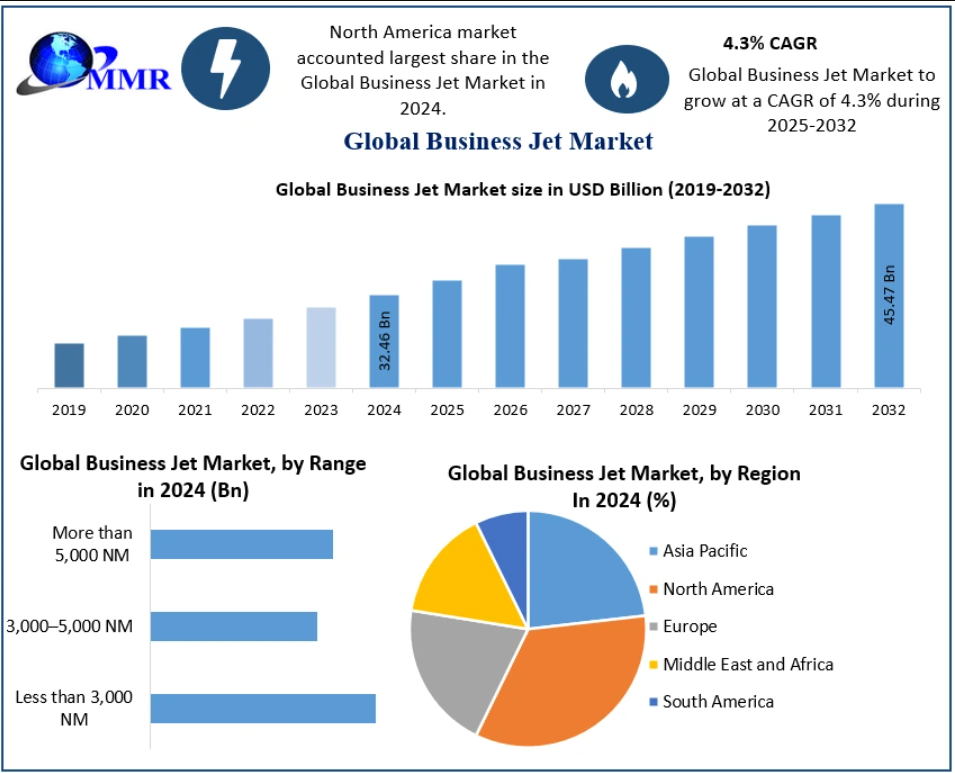

The Business Jet Market, valued at USD 32.46 billion in 2024, is poised for steady expansion, projected to reach USD 45.47 billion by 2032, at a CAGR of 4.3%. This growth reflects a shifting landscape driven by the rise of global corporate mobility, expanding high-net-worth demographics, infrastructure modernization, and rapid technology advancements in aviation.

Market Overview

Business jets continue to be an essential tool for corporate travel, high-net-worth individuals (HNWIs), and charter operators. Their value goes beyond luxury—offering flexibility, time efficiency, and direct connectivity that commercial aviation cannot match.

Market growth moves in tandem with:

- Global economic cycles

- Corporate profitability

- Expansion of transnational business activity

- Technological improvements in aircraft design

As global wealth rises—especially in Asia-Pacific and the Middle East—demand for exclusive and efficient air travel solutions is accelerating.

Manufacturers are increasingly integrating advanced avionics, lightweight composites, next-generation engines, and cabin digitalization, reshaping customer expectations for comfort, speed, and sustainability.

Click here to claim your free sample report and uncover the most lucrative market segments: https://www.maximizemarketresearch.com/request-sample/115116/

Market Dynamics

- Driver: Airport Infrastructure Expansion Bolsters Market Demand

Rapid infrastructure development around the world is one of the strongest growth drivers for business aviation.

Key factors include:

- Modernized runways and taxiways supporting diverse aircraft sizes

- Dedicated business aviation terminals (FBOs) with VIP lounges, immigration fast-tracking, and premium ground handling

- Advanced air traffic control systems ensuring optimized routing, reduced congestion, and safer operations

Countries with dense aviation networks—particularly the United States, which has over 5,000 airports—create unmatched operational advantages for private jet users.

In contrast, emerging markets such as India, with only 251 airports for over 1.1 billion people, represent enormous opportunity for future growth as infrastructure expands.

- Restraint: Regulatory Complexities Limit Market Agility

The business jet ecosystem faces several regulatory challenges:

| Regulatory Category | Impact on Market |

| Safety Regulations | Higher costs for engineering, testing, and certification |

| Airspace Restrictions | Reduced route flexibility and increased operational delays |

| Environmental Standards | Demand for low-emission engines and quiet aircraft |

| Airport Regulations | Limited runway access, noise curfews |

| Taxation & Fees | Higher ownership and operational costs |

| Security Protocols | Stricter screening and compliance |

| Import/Export Rules | Tariffs and export-control delays |

These regulatory factors, while essential for aviation safety and sustainability, can slow product deployment and raise ownership costs for end users.

- Opportunity: Innovation Accelerates Market Expansion

Next-generation business jets are emerging as a key opportunity:

- Fuel-efficient engines and optimized aerodynamics reducing operational costs

- Advanced connectivity and smart cabins turning aircraft into digital workplaces

- Hybrid-electric and hydrogen propulsion R&D supporting sustainability goals

- Highly customized interiors tailored for luxury travel, government use, or corporate boardrooms

Sustainability is a major theme, with manufacturers investing heavily in Sustainable Aviation Fuel (SAF) and eco-friendly flight technologies. These innovations are opening new demand segments, especially among corporate buyers with ESG mandates.

Segment Analysis

By Aircraft Type

Large jets dominated the market in 2024, driven by:

- Extended range (for intercontinental travel)

- Spacious cabins for 12–19 passengers

- Advanced entertainment, connectivity, and luxury configurations

Despite fewer deliveries than light jets, their higher price and superior capabilities continue to strengthen their market share.

By Range

- More than 5,000 NM aircraft are in rising demand due to global business expansion.

- Ultra-long-range jets support direct travel between major business hubs such as New York–Tokyo, Dubai–London, and Singapore–San Francisco.

By End Use

- Private individuals and corporate executives remain primary users.

- The operator segment (charter services, fractional ownership) is expanding due to cost-efficiency and flexible usage patterns.

By Point of Sale

- OEM segment leads due to strong demand for new-generation aircraft.

- The aftermarket—maintenance, avionics upgrades, cabin refurbishments—is growing steadily with the rising global fleet.

Click here to claim your free sample report and uncover the most lucrative market segments: https://www.maximizemarketresearch.com/request-sample/115116/

Regional Insights

- North America – Global Leader

North America—especially the United States—dominates due to:

- Large population of HNWIs and corporate users

- Presence of leading manufacturers (Gulfstream, Textron, Bombardier)

- Extensive airport network and supportive regulatory environment

- Strong penetration of FBO networks

The region accounted for the largest share of global deliveries in 2024.

- Europe

Demand driven by:

- Strong business aviation culture in Germany, France, and the UK

- Growth in cross-border corporate travel

- Investments in sustainable aviation and SAF infrastructure

- Asia-Pacific

Fastest-growing region, led by:

- Rising wealth in China and India

- Growing corporate expansions into Southeast Asia

- Infrastructure development across APAC

- Middle East & Africa

Growth led by:

- Strong demand from UAE, Saudi Arabia, and Qatar

- Government investments in aviation hubs

- High use for VIP transport and state missions

- South America

Moderate growth, driven by corporate usage in Brazil and Argentina.

Competitive Landscape

Key market leaders include:

North America

General Dynamics (Gulfstream), Textron, Boeing, Stratos Aircraft, Lockheed Martin, Boom Supersonic, Zunum Aero

Europe

Dassault Aviation, Airbus Group, Pilatus, Piaggio Aero, Lilium

Asia-Pacific

China Aviation Technology Industry

Middle East & Africa

Sukhoi Civil Aircraft, Urban Aeronautics

Manufacturers are increasingly competing on range, cabin luxury, avionics, fuel efficiency, and sustainability innovations .

Conclusion

The Business Jet Market is entering a period of steady and technologically driven growth . While regulatory challenges and economic fluctuations create headwinds, the long-term outlook remains positive due to:

- Rapid global wealth creation

- Expansion of airport infrastructure

- Strong adoption of next-gen aviation technologies

- Rising preference for private, flexible, and secure air travel

By 2032, the market's transformation will be shaped by sustainability initiatives, advanced manufacturing, and digital aviation ecosystems , redefining the future of business mobility.