Global Data Center Market: A Deep-Dive Analysis (2024–2030)

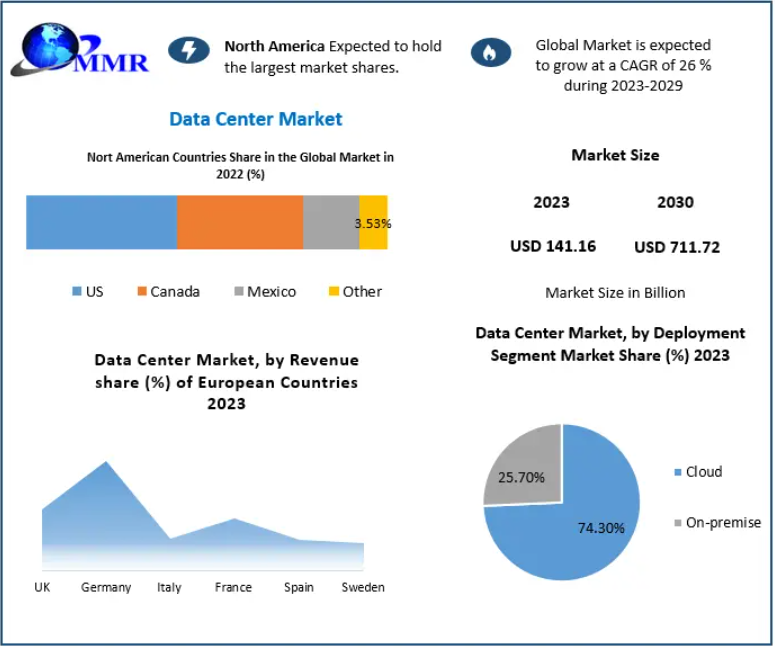

The Global Data Center Market reached USD 141.16 billion in 2023 and is forecast to skyrocket to USD 711.72 billion by 2030, expanding at an impressive CAGR of 26%. This explosive growth reflects the rising digital transformation wave, AI adoption, cloud computing penetration, and the global shift toward data-driven operations across industries.

Market Overview

A data center is a mission-critical facility where organizations store, manage, and process their data and applications. These facilities integrate computing, storage, networking, cooling systems, and security infrastructure—forming the technological backbone of the modern digital economy.

As global enterprises prioritize cost efficiency, performance, and scalability, many are moving away from on-premises infrastructure and shifting toward colocation services, hyperscale platforms, and hybrid-cloud ecosystems. This transition has transformed data centers into highly sophisticated environments capable of supporting large-scale cloud access, AI workloads, and emerging technologies like IoT and 5G.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/24271/

Key Market Dynamics

- Proven Advantages of Large Data Center Markets

Established data center hubs benefit from strong relationships with local authorities, advanced utility infrastructure, and regulatory stability. These markets pose lower risks due to:

- Better access to power and land

- Skilled on-site workforce

- Faster approvals for expansion

However, emerging markets face obstacles, including complex licensing processes and limited grid capacity.

- Capital Influx Fuels Industry Expansion

Over the past decade, the sector has attracted over USD 100 billion in global investments. Key investors include:

- Sovereign wealth funds

- Pension funds

- Private equity players

- Infrastructure funds

Rather than purchasing assets individually, investors are increasingly backing data center platforms—boosting cost efficiencies, operational scale, and market consolidation.

- Cloud Migration and Hyperscale Growth

Enterprises are rapidly moving workloads to third-party facilities and cloud service providers. Hyperscale giants—AWS, Google Cloud, Microsoft Azure—are signing massive leases exceeding 30 MW to 100 MW, reflecting unprecedented demand.

This shift has transformed traditional data center designs into massive multi-building campuses, particularly to support:

- High-density AI computing

- Real-time analytics

- SaaS/Cloud-native applications

- Large-scale enterprise data workloads

- The Emergence of Edge Computing

The rise of IoT, autonomous vehicles, AR/VR, and 5G necessitates low-latency computing. As a result, edge data centers—small, localized facilities—are becoming essential for:

- Smart cities

- Retail and logistics

- Telecom infrastructure

- Industrial automation

- XaaS (Everything-as-a-Service) Accelerates Demand

The demand for XaaS is surging, rising 42% YoY in H1 2022. With companies now using 100+ SaaS applications on average, data centers serve as the backbone supporting massive SaaS, PaaS, and IaaS workloads.

Valuation & Market Insights

Rising inflation, global supply chain disruptions, and utility cost fluctuations are impacting development costs. Key valuation drivers include:

- Access to cheap power

- Speed to market

- Lease terms and tenant profile

- Fiber density

- Modular and scalable facility design

High-capacity and fiber-rich facilities continue to command premium valuations.

Data Center Market Segment Analysis

By Type

- Hyperscale Data Centers — Market Leader (40% share in 2023)

Driven by:

- High cooling efficiency

- Automation and balanced workload distribution

- Scalability for AI, cloud, and big data applications

- Cloud Data Centers

Projected to grow at 5.4% CAGR due to the adoption of flexible, scalable, cloud-native architectures.

- Traditional Data Centers

Gradually witnessing slower growth due to modernization pressure.

By Application

- BFSI — Dominant Sector (26% share)

Data centers are the backbone of digital banking, supporting:

- Fraud detection

- Real-time payments

- Core banking systems

- Large transaction volumes

- IT & Telecom — Fastest Growing (7% CAGR)

Supports high-volume data traffic, 5G infrastructure, and enterprise workflows.

By Deployment

- On-Premise — Largest Share (56.4% in 2023)

Preferred for:

- Data-sensitive industries

- Enhanced security and control

- Proprietary infrastructure management

- Cloud Deployment

Driven by hybrid IT transformations, scalability, and reduced capex.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/24271/

Regional Analysis

- North America — Market Leader (35% share in 2023)

Key growth drivers:

- Presence of global hyperscale giants

- Strong cloud adoption

- High investment from tech giants and colocation providers

Northern Virginia, the world’s largest data center hub, faces power constraints that are pushing developers to secondary markets such as:

- Phoenix

- Portland

- Columbus

- Asia Pacific — Fastest Growing Region (6.7% CAGR)

Growth fueled by:

- 5G deployments

- Massive digitalization in India, China, and South Korea

- Rise of fintech and digital banking

- Cloud adoption among SMEs

- Europe

Focus on sustainability, green data centers, and renewable-powered facilities drives demand.

Competitive Landscape

North America

- Digital Realty

- Nvidia

- Oracle

- Alphabet Inc. (Google)

- IBM

- Cisco

- HPE

- Equinix

Europe

- Capgemini

- Schneider Electric

- Vertiv

- IBM

- HPE

- Equinix

Asia Pacific

- Fujitsu

- Hitachi

- Huawei

- Reliance Group

- Sify Technologies

Companies are focusing on:

- Renewable energy adoption

- Modular data center designs

- AI-driven optimization

- Strategic mergers and acquisitions

- Expansion into secondary and edge markets

Conclusion

The Global Data Center Market is entering a transformative decade marked by hyperscale dominance, cloud acceleration, AI-driven workloads, and high investor appetite. While challenges like power constraints, supply chain delays, and rising development costs persist, the long-term outlook remains overwhelmingly positive.

With businesses shifting to digital-first models and the global data explosion driven by AI, IoT, 5G, and cloud technologies, the demand for next-generation data centers will continue its exponential rise.