Banking Encryption Software Market Overview

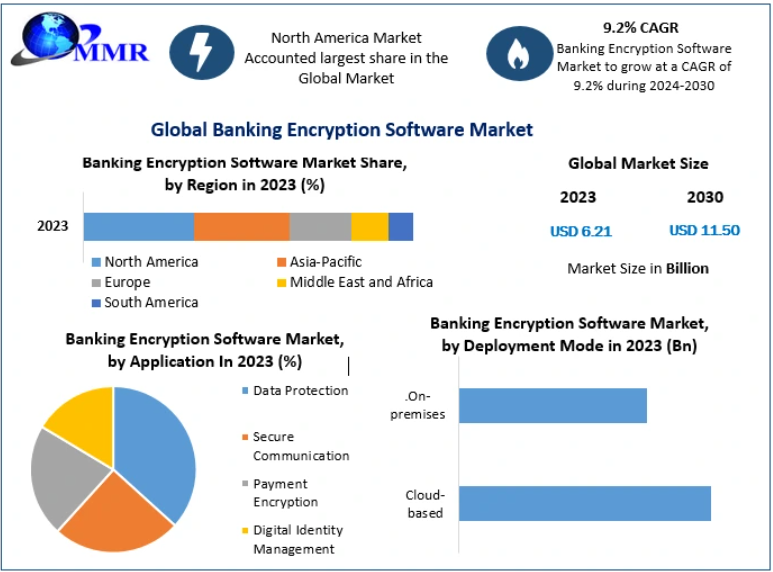

The Global Banking Encryption Software Market is witnessing steady expansion and is projected to reach USD 11.50 billion by 2030, growing at a CAGR of 9.2% from 2024 to 2030. This growth reflects the increasing need for advanced cybersecurity solutions across the global banking ecosystem as financial institutions accelerate their digital transformation initiatives.

Banking encryption software refers to specialized security solutions designed to protect sensitive financial data, customer information, and digital transactions from unauthorized access and cyber threats. These solutions ensure data confidentiality, integrity, and authenticity across multiple banking platforms, including online banking, mobile applications, cloud infrastructure, and digital payment systems.

With banks increasingly relying on digital channels for service delivery, encryption has become a foundational component of cybersecurity strategies. The rising frequency of cyberattacks, combined with strict regulatory compliance requirements, continues to drive demand for robust encryption technologies across the banking sector.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/189648/

Market Growth Drivers

Rising Cybersecurity Threats

Financial institutions remain prime targets for cybercriminals due to the high value of financial and personal data. Increasingly sophisticated cyberattacks, including ransomware, phishing, and data breaches, have compelled banks to invest heavily in encryption software to safeguard transactions and sensitive customer information.

Regulatory and Compliance Mandates

Global regulatory frameworks such as PCI DSS, GDPR, and financial security mandates enforced by regulatory authorities require banks to implement strong encryption mechanisms. Compliance with these standards is a major driver fueling the adoption of encryption software across retail, commercial, and investment banking segments.

Rapid Digitization of Banking Services

The growing use of mobile banking apps, digital wallets, cloud banking platforms, and electronic payment systems has expanded the attack surface for cyber threats. Encryption software plays a critical role in protecting data both at rest and in transit, supporting secure digital banking operations.

Market Opportunities

Expansion of Cloud-Based Banking Infrastructure

As banks migrate workloads to cloud platforms to improve scalability and operational efficiency, demand for cloud-compatible encryption solutions is rising. Vendors offering end-to-end encryption and secure key management for cloud environments are well-positioned to capitalize on this trend.

Integration with Blockchain and Open Banking

The adoption of blockchain technology for secure transactions and the emergence of open banking frameworks create new opportunities for encryption software providers. Secure API-based data sharing under open banking models requires advanced encryption to ensure data privacy and customer trust.

Growth in Digital Identity and Authentication Solutions

Encryption solutions integrated with digital identity management and authentication systems—especially in multi-factor and biometric authentication—are gaining traction as banks seek enhanced protection against identity fraud.

Market Restraints

High Implementation and Integration Costs

Implementing encryption software within legacy banking systems can be complex and costly. Many banks operate on outdated infrastructure that requires significant upgrades to support modern encryption technologies, which can deter smaller financial institutions from adoption.

Impact on User Experience

While encryption enhances security, it can introduce additional authentication steps or processing delays. Balancing strong security measures with seamless user experience remains a challenge for both banks and encryption software providers.

Market Challenges

Rapidly Evolving Cyber Threat Landscape

Cybercriminals continuously develop new methods to bypass security systems, forcing encryption software vendors to invest heavily in R&D to enhance algorithms, key management practices, and threat detection capabilities.

Limited Awareness and Skill Gaps

A lack of deep understanding of encryption technologies among banking professionals and end users can slow adoption. Vendors must invest in education, training, and awareness initiatives to bridge this knowledge gap and promote best practices.

Key Market Trends

Growing Adoption of Cloud-Based Encryption

Cloud-native encryption solutions are increasingly favored due to their flexibility, scalability, and real-time security capabilities. These solutions support secure cloud migration strategies for banks worldwide.

AI and Machine Learning Integration

The integration of AI and machine learning into encryption software enables proactive threat detection, anomaly identification, and automated security responses, significantly strengthening overall data protection.

Biometric Authentication Integration

Encryption solutions combined with biometric authentication—such as fingerprint and facial recognition—are becoming mainstream, enhancing identity verification accuracy and reducing fraud risks.

Blockchain-Enabled Encryption Solutions

Blockchain-based encryption is emerging as a secure method for ensuring data integrity, transparency, and immutability in financial transactions, further strengthening trust in digital banking systems.

Market Segmentation Analysis

By Deployment Mode

- Cloud-based

- On-premises

By Encryption Type

- Symmetric Encryption

- Asymmetric Encryption

- Hashing Algorithms

By Application

- Data Protection

- Secure Communication

- Payment Encryption

- Digital Identity Management

By End User

- Retail Banks

- Commercial Banks

- Investment Banks

- Other Financial Institutions

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/189648/

Regional Insights

North America

North America dominates the market due to strict regulatory frameworks, advanced banking infrastructure, and high cybersecurity spending. The United States leads regional adoption with a strong focus on data privacy.

Europe

Europe represents a mature market driven by GDPR compliance and robust data protection laws. Countries such as Germany, the UK, and France are at the forefront of encryption adoption.

Asia Pacific

Asia Pacific is the fastest-growing region, supported by rapid digitization, expanding banking services, and increasing cyber risks in countries like China, India, Japan, and Australia.

Latin America

Rising digital payments and growing awareness of data security are driving steady adoption of encryption solutions across Brazil, Mexico, and Argentina.

Middle East & Africa

Increasing investments in banking infrastructure and heightened cybersecurity initiatives are accelerating market growth in the UAE, Saudi Arabia, and South Africa.

Competitive Landscape

The Banking Encryption Software Market is moderately concentrated, with established global players holding significant market share alongside emerging regional vendors. Competition is driven by innovation, scalability, regulatory compliance, ease of integration, and customer support.

Key players focus on:

- Continuous product innovation

- Strategic partnerships

- Expansion into cloud and AI-driven encryption solutions

- Compliance-focused offerings

Conclusion

The Banking Encryption Software Market is positioned for sustained growth as banks worldwide strengthen their cybersecurity frameworks in response to rising digital threats and regulatory pressures. Advancements in cloud computing, AI, blockchain, and biometric security are reshaping encryption technologies, creating long-term opportunities for solution providers. As financial institutions continue to digitize operations, encryption software will remain a critical pillar in ensuring secure, compliant, and trustworthy banking ecosystems.