Global Herbal Supplements Market Overview

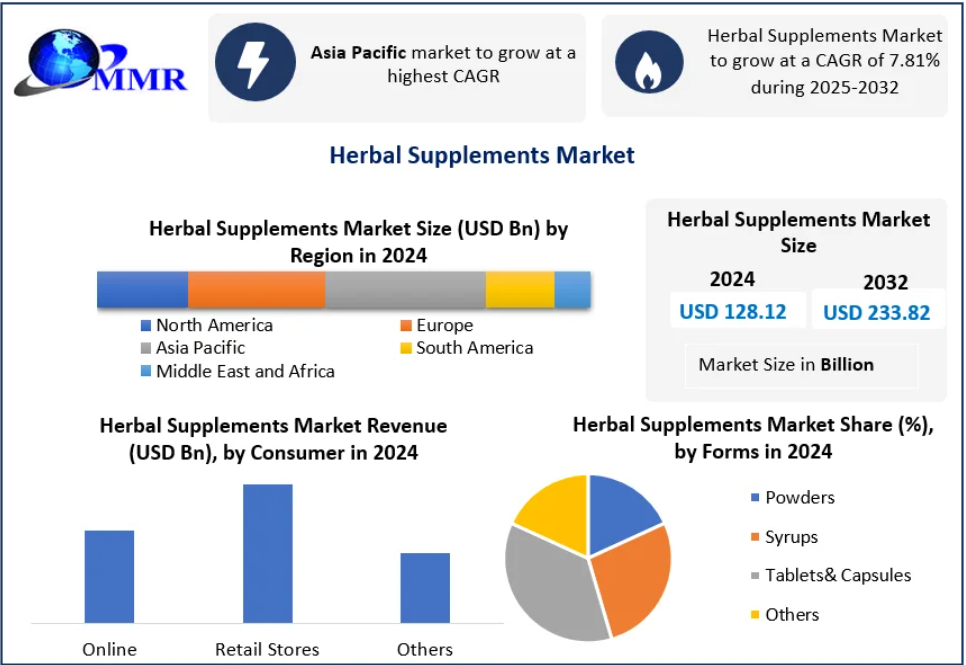

The Herbal Supplements Market was valued at USD 128.12 Billion in 2024 and is projected to reach approximately USD 233.82 Billion by 2032, expanding at a CAGR of 7.81% from 2025 to 2032. Herbal supplements are plant-based formulations designed to support overall wellness, prevent lifestyle-related disorders, and complement nutritional intake. These products are available in multiple formats, including tablets, capsules, powders, syrups, gummies, and liquid extracts, catering to diverse consumer preferences.

Rising awareness regarding preventive healthcare, increasing incidence of chronic and stress-related conditions, and growing inclination toward natural and organic remedies are key factors driving market growth. Consumers across age groups are increasingly incorporating herbal supplements into daily routines as part of holistic wellness and alternative medicine practices. Easy accessibility through pharmacies, health stores, supermarkets, and rapidly expanding online platforms further supports market expansion.

Asia Pacific emerged as the leading regional market in 2024, supported by strong traditional medicine systems such as Ayurveda and Traditional Chinese Medicine (TCM). Globally, the market remains highly competitive and fragmented, with established brands and emerging wellness startups continuously innovating to meet evolving consumer expectations.

𝐂𝐥𝐢𝐜𝐤 𝐡𝐞𝐫𝐞 𝐓𝐨 𝐠𝐞𝐭 𝐰𝐞𝐥𝐥-𝐫𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐫𝐞𝐩𝐨𝐫𝐭:https://www.maximizemarketresearch.com/request-sample/20657/

Herbal Supplements Market Scope and Research Methodology

This report offers a detailed evaluation of the global Herbal Supplements Market, analyzing historical trends from 2019 to 2024 and providing forecasts through 2032. The scope includes an assessment of market size, growth drivers, restraints, opportunities, regulatory frameworks, and competitive dynamics across major regions.

The research methodology is based on a combination of primary and secondary research. Primary research involved interviews with industry experts, manufacturers, distributors, and healthcare professionals. Secondary research included data from company annual reports, government publications, trade journals, and credible industry databases.

Market sizing was conducted using top-down and bottom-up approaches, followed by data triangulation to ensure accuracy. Analytical tools such as PESTEL analysis and PORTER’s Five Forces were employed to evaluate macroeconomic influences, regulatory challenges, competitive intensity, and supply-demand dynamics. The report provides actionable insights for manufacturers, investors, and policymakers operating in the herbal supplements ecosystem.

Herbal Supplements Market Segmentation

By Form

- Powders

- Syrups

- Tablets & Capsules

- Others (Gummies, Softgels, Liquid Extracts)

Tablets & capsules accounted for the largest market share in 2024 due to their convenience, standardized dosing, longer shelf life, and widespread consumer acceptance. Powders are gaining popularity among fitness and wellness enthusiasts for flexible dosage options, while syrups are preferred by pediatric and geriatric users. Emerging formats such as gummies and liquid extracts are witnessing strong growth, driven by improved taste profiles and faster absorption.

By Distribution Channel

- Pharmaceutical Stores

- Personal Care & Specialty Stores

- Online Retailers

- Supermarkets / Hypermarkets

- Others (Direct Sales, Health Clinics)

Pharmaceutical stores dominated the market in 2024, supported by consumer trust, professional guidance from pharmacists, and availability of reputed brands. Online retailers are rapidly gaining traction due to convenience, subscription models, and access to a broader product range.

By Consumer Purchase Channel

- Retail Stores

- Online Platforms

- Others (Direct Sellers, Wellness Clinics)

Retail stores continue to lead, as consumers value immediate availability and product authenticity. However, online platforms are witnessing accelerated growth, particularly among younger, digitally engaged consumers.

𝐂𝐥𝐢𝐜𝐤 𝐡𝐞𝐫𝐞 𝐓𝐨 𝐠𝐞𝐭 𝐰𝐞𝐥𝐥-𝐫𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐫𝐞𝐩𝐨𝐫𝐭:https://www.maximizemarketresearch.com/request-sample/20657/

Herbal Supplements Market Regional Insights

Asia Pacific dominated the Herbal Supplements Market in 2024, accounting for approximately 42% of global revenue. The region benefits from long-standing traditional medicine practices, strong domestic manufacturing, and supportive government initiatives such as India’s AYUSH Mission and China’s TCM modernization programs. China and India collectively represent a significant share of global herbal supplement exports.

North America is the fastest-growing region, driven by rising preventive healthcare adoption, high supplement consumption rates, and increasing acceptance of plant-based nutrition. Regulatory oversight by the FDA is encouraging higher product quality, transparency, and clinical validation.

Europe remains a quality-centric market, led by countries such as Germany and Switzerland, where strict organic certifications and consumer preference for scientifically validated supplements shape purchasing behavior.

The Middle East & Africa and South America markets are steadily expanding, supported by increasing health awareness, urbanization, and growth of organized retail and e-commerce channels.

Key Players in the Herbal Supplements Market

The Herbal Supplements Market is highly fragmented, with global brands, regional leaders, and niche wellness companies competing on product quality, formulation science, pricing, and brand trust.

North America

- Herbalife International of America, Inc.

- Nutraceutical International Corporation

- NOW Health Group, Inc.

- Swanson Health

- Nature's Way

- Jarrow Formulas, Inc.

- Bio-Botanica Inc.

- Herb Pharm

Europe

- Glanbia PLC (Ireland)

- Ricola AG (Switzerland)

Asia Pacific

- Himalaya Herbal Healthcare (India)

- Herbochem (India)

- Nutrova (India)

- Naturalife Asia Co., Ltd. (Thailand)

- Blackmores Limited (Australia)

Global Multi-Regional Players

- Archer Daniels Midland Company (ADM)

- NBTY, Inc.

Leading companies focus on science-backed formulations, clean-label ingredients, personalized nutrition solutions, and digital distribution strategies to strengthen their market presence. Strategic expansions, regulatory compliance, and investments in clinical research remain central to sustaining long-term competitiveness.