September 17, 2025 – [City, Country] – The global Natural Surfactants Market is expected to grow significantly over the next several years, expanding from USD 11.56 billion in 2021 to USD 16.07 billion by 2028 , at a compound annual growth rate (CAGR) of 5.0% from 2022 to 2028 , according to a comprehensive market research report titled “Natural Surfactants Market” Forecast to 2028 – COVID-19 Impact and Global Analysis by Type and Application.”

The report provides in-depth insights into the market dynamics, segmentation by type and application, impact of the COVID-19 pandemic, and key trends shaping the natural surfactants industry globally.

Market Overview: Sustainable Growth Anchored in Innovation

Natural surfactants—also known as bio-based surfactants—are surface-active agents derived from renewable plant or animal sources such as coconut oil, palm oil, sugar, and starch. Unlike their synthetic counterparts, natural surfactants are biodegradable, less toxic, and environmentally friendly. These characteristics make them increasingly favored in applications spanning from personal care and detergents to industrial and agricultural products.

Driven by growing environmental awareness, government regulations promoting sustainable chemical use, and increasing consumer demand for “green” and biodegradable products, the natural surfactants market is experiencing robust global expansion.

Segmentation by Type: Market Breakdown

The report categorizes the natural surfactants market into four main types based on their ionic behavior:

• Anionic Surfactants

Anionic surfactants accounted for a significant share of the market in 2021 and continue to dominate due to their cost-effectiveness and superior cleansing and foaming properties. They are widely used in detergents, laundry soaps, and industrial cleaning products.

• Cationic Surfactants

Cationic surfactants, known for their antimicrobial and conditioning properties, are primarily used in hair conditioners, fabric softeners, and disinfectants. Their market share is steadily growing, particularly in the personal care sector.

• Non-Ionic Surfactants

Non-ionic surfactants are gaining popularity due to their mildness and compatibility with sensitive skin. These surfactants are widely used in personal care products, cosmetics, and baby care formulations.

• Amphoteric Surfactants

Amphoteric surfactants, capable of carrying both positive and negative charges depending on pH levels, are known for their excellent foaming ability and low irritation potential. They are particularly prevalent in skincare, shampoos, and body washes.

Segmentation by Application: Expanding Use Across Industries

The natural surfactants market is also segmented by application, which includes:

• Detergents

The detergent segment holds the largest share of the market. Consumers increasingly prefer eco-labeled, sulfate-free cleaning products that are gentle on the environment and human health.

• Personal Care

The rising demand for organic and natural personal care products has led to increased adoption of natural surfactants in skin care, hair care, and cosmetics. These surfactants offer safer, gentler alternatives to synthetic ingredients.

• Industrial & Institutional Cleaning

This segment includes cleaning products used in commercial, institutional, and industrial environments such as hospitals, schools, and factories. The demand for environmentally responsible cleaning agents has boosted the use of natural surfactants in this sector.

• Oilfield Chemicals

Natural surfactants are used in enhanced oil recovery and drilling applications, where sustainability is becoming a key consideration in reducing environmental impact.

• Agricultural Chemicals

Bio-based surfactants are used to enhance the effectiveness of herbicides, pesticides, and fertilizers, offering improved spreading and wetting properties while minimizing environmental toxicity.

• Others

Other applications include textiles, paints and coatings, and the food industry, where natural surfactants are increasingly being adopted due to safety and regulatory compliance.

COVID-19 Impact: Short-Term Disruptions, Long-Term Opportunities

The COVID-19 pandemic initially caused disruptions in global supply chains, impacting the availability of raw materials and slowing manufacturing operations. However, the crisis also created lasting shifts in consumer behavior. The increased emphasis on hygiene and personal health during the pandemic led to a surge in demand for cleaning and personal care products formulated with safe, non-toxic, and sustainable ingredients.

As a result, the natural surfactants market not only rebounded quickly but also gained momentum post-pandemic, with major brands accelerating their transition to natural formulations.

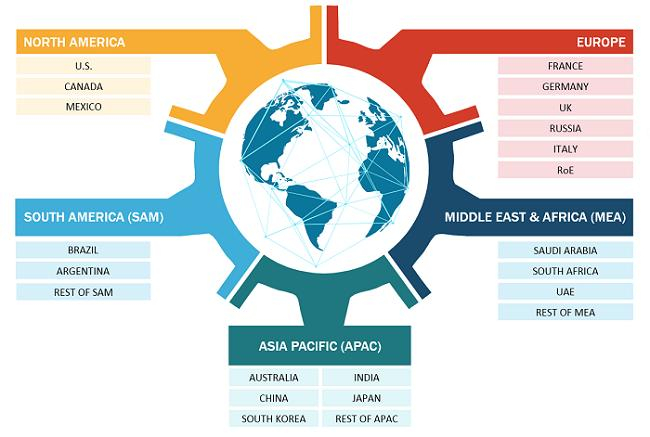

Regional Insights: Global Growth with Regional Drivers

• North America and Europe

These regions are leading the natural surfactants market, supported by advanced regulatory frameworks, mature consumer awareness, and strong research and development activities. Initiatives promoting sustainability, including the European Green Deal and U.S. EPA Safer Choice Program, have further propelled growth.

• Asia Pacific

Asia Pacific is emerging as the fastest-growing market, driven by rapid industrialization, urbanization, and rising consumer demand for natural products in countries like China, India, and South Korea. The presence of a strong manufacturing base and increasing investment in green chemistry are also contributing to regional expansion.

• Latin America, Middle East, and Africa

These regions are showing potential for growth due to increasing regulatory focus on environmental protection and the gradual adoption of sustainable agricultural and industrial practices.

Market Drivers and Trends

Several key drivers are influencing the growth of the natural surfactants market:

-

Increased demand for biodegradable and non-toxic alternatives to synthetic surfactants

-

Regulatory pressures favoring environmentally friendly formulations

-

Consumer preference for clean-label and plant-based products

-

Corporate sustainability goals across industries

-

Technological innovations in bio-based surfactant production

Additionally, companies are focusing on diversifying raw material sources to include algae, soy, and agricultural waste, further reducing environmental impact and production costs.

Challenges and Restraints

Despite the promising outlook, the natural surfactants market faces several challenges:

-

Higher production costs compared to conventional surfactants

-

Inconsistent availability of raw materials from renewable sources

-

Performance limitations in high-stress industrial applications

-

Need for consumer education regarding benefits and efficacy

Ongoing investment in biotechnology, process optimization, and public awareness campaigns are expected to mitigate these challenges in the coming years.

Competitive Landscape

Leading market players are actively investing in product innovation, mergers, acquisitions, and partnerships to enhance their market position. Key companies in the natural surfactants space include:

-

BASF S.E.

-

Clariant AG

-

Croda International Plc

-

Stepan Company

-

Evonik Industries AG

-

Sasol Limited

-

Solvay SA

These companies are emphasizing the development of high-performance, sustainable surfactant technologies to meet the evolving customer and regulatory demands.

Outlook: A Promising Future for Green Chemistry

The future of the natural surfactants market is bright, fueled by the global shift toward sustainability, eco-conscious product development, and responsible industrial practices. With increasing demand across personal care, cleaning, agriculture, and industrial sectors, natural surfactants are set to play a pivotal role in the next generation of environmentally friendly solutions.

As companies and consumers alike prioritize planet-friendly ingredients, the transition from synthetic to natural surfactants will become not just a market trend—but an industry standard.