Global Automotive Gearbox Market: Powering Next-Generation Mobility

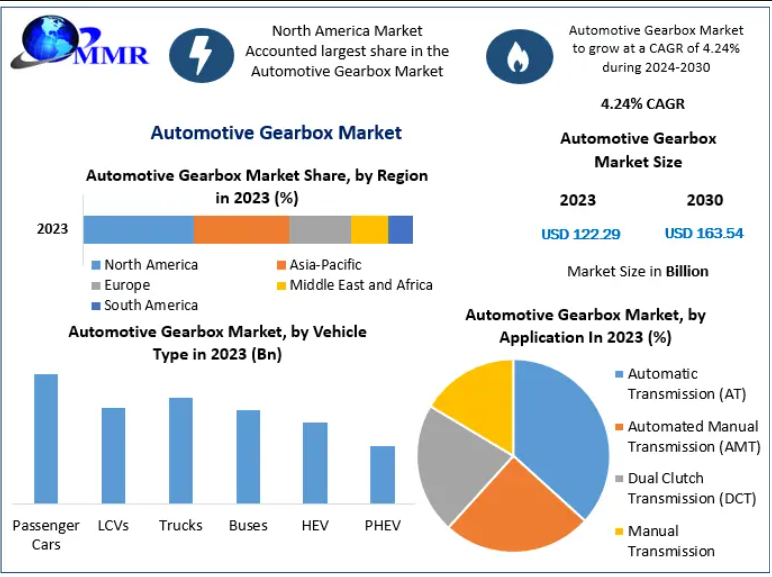

The Global Automotive Gearbox Market was valued at USD 122.29 billion in 2023 and is projected to reach USD 163.54 billion by 2030, growing at a CAGR of 4.24% during the forecast period (2024–2030). The market’s expansion is primarily driven by rising vehicle production, the growing adoption of automatic transmission systems, and the increasing demand for fuel-efficient and performance-oriented vehicles.

Automotive Gearbox Market Overview

An automotive gearbox is a critical component in vehicles that transfers power from the engine to the wheels, ensuring efficient torque and speed management. The market is undergoing significant transformation as technological advancements, electrification, and automation reshape transmission design and efficiency.

The rapid increase in passenger car production, coupled with rising consumer demand for comfort and smooth driving experiences, is accelerating the adoption of advanced transmission systems such as Automatic Transmission (AT), Automated Manual Transmission (AMT), and Dual Clutch Transmission (DCT).

While manual gearboxes continue to dominate in developing nations due to their affordability and simple mechanics, the global trend is clearly shifting toward automatic and hybrid systems—especially in urban and luxury vehicle segments.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/10981/

Automotive Gearbox Market Dynamics

1. Rising Demand for Automatic and Semi-Automatic Transmissions

Consumers worldwide are increasingly prioritizing convenience and seamless driving experiences, driving strong growth in the automatic transmission segment. Automatic and dual-clutch systems are becoming the preferred choice for premium and mid-range vehicles due to smoother gear shifts, better fuel efficiency, and advanced control systems.

Developing markets like India, China, and Brazil, traditionally dominated by manual transmissions, are witnessing a gradual but steady shift toward automatic and hybrid gearboxes, supported by urbanization, rising disposable incomes, and traffic congestion in metro cities.

2. Passenger Car Segment Dominating Market Growth

The passenger car segment accounted for the largest market share in 2023 and is expected to continue leading through 2030. This dominance is attributed to the high production volumes of passenger cars, the increasing popularity of SUVs and luxury vehicles, and enhanced consumer focus on vehicle performance and fuel efficiency.

In regions such as Europe and North America, luxury and light-duty vehicles equipped with multi-speed transmissions are driving significant demand.

3. Impact of Electrification and Hybridization

The rise of electric and hybrid electric vehicles (HEVs and PHEVs) is transforming gearbox technology. While pure EVs often require fewer gears, hybrid vehicles are incorporating advanced multi-speed and lightweight gearboxes to optimize power delivery and range. Manufacturers are investing heavily in lightweight materials, planetary gearsets, and smart electronic control units (ECUs) to ensure compatibility with new-age powertrains.

4. Challenges: Cost and Technical Complexity

While automated and dual-clutch systems offer performance benefits, their high production and maintenance costs pose challenges in cost-sensitive markets. Additionally, complex calibration requirements for modern transmissions may increase R&D costs for automakers, especially when integrated with hybrid or electric powertrains.

Regional Insights

Asia-Pacific (APAC)

The Asia-Pacific region dominates the global market, led by China, Japan, India, and South Korea. The region’s strong automotive manufacturing base, rapid urbanization, and growing middle-class population are fueling gearbox demand.

India, in particular, remains a key growth engine, with increasing adoption of AMT and DCT systems in compact and mid-segment cars.

Europe

Europe holds a significant market share due to its focus on fuel-efficient, high-performance vehicles and strict CO₂ emission standards. Premium automakers such as BMW, Volkswagen, and Mercedes-Benz are integrating advanced automatic and dual-clutch systems in their vehicle lineups to improve performance and compliance.

North America

The North American market is characterized by high penetration of automatic transmissions, especially in SUVs, trucks, and luxury cars. The presence of major manufacturers and strong consumer preference for comfort and power supports steady market growth.

Middle East, Africa, and Latin America

Emerging markets in these regions are gradually shifting from manual to automated systems. Growth is expected to be moderate, driven by increasing vehicle ownership and infrastructure development.

Segment Analysis

| Segment | Details |

|---|---|

| By Application | Automatic Transmission (AT), Automated Manual Transmission (AMT), Dual Clutch Transmission (DCT), Manual Transmission |

| By Number of Gears | 3–5, 6–8, Above 8 |

| By Vehicle Type | Passenger Cars, LCVs, Trucks, Buses, HEV, PHEV |

| By Off-Highway Vehicle Type | Agricultural Tractors, Construction Equipment |

The 6–8 gear segment is expected to grow significantly due to increasing integration in modern vehicles, enhancing fuel efficiency and driving dynamics.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/10981/

Competitive Landscape

The global automotive gearbox market is moderately consolidated, with key players focusing on technological innovation, lightweight materials, and strategic collaborations.

Key Companies:

-

Aisin Seiki Co. Ltd.

-

ZF Friedrichshafen AG

-

Magna Powertrain

-

Jatco Ltd.

-

BorgWarner Inc.

-

Eaton Corporation

-

Continental AG

-

Getrag Corporate Group

-

Volkswagen AG

-

Groupe Renault

-

Hyundai Motor Company

-

Schaeffler AG

-

AVTEC, Optigear, BONENG, Anchor Industries, A1 Cardone, All Star Performance, Bendix, and Gyros Gear Industries

Recent Developments:

-

ZF Friedrichshafen introduced next-generation 8-speed hybrid transmissions optimized for electric and plug-in hybrid vehicles.

-

Aisin Seiki partnered with Toyota to develop ultra-compact transmissions for hybrid models.

-

BorgWarner expanded its dual-clutch transmission portfolio to improve fuel efficiency in passenger vehicles.

Conclusion

The Global Automotive Gearbox Market is evolving in response to consumer demand for comfort, performance, and sustainability. As automakers transition toward electrification, the integration of smart, lightweight, and efficient transmission systems will play a critical role in shaping the future of mobility.

With continuous innovation from leading manufacturers and growing adoption in emerging markets, the automotive gearbox industry is set to remain a vital driver of global automotive performance and efficiency.