Helicopter Market: Global Industry Outlook and Strategic Analysis (2025–2032)

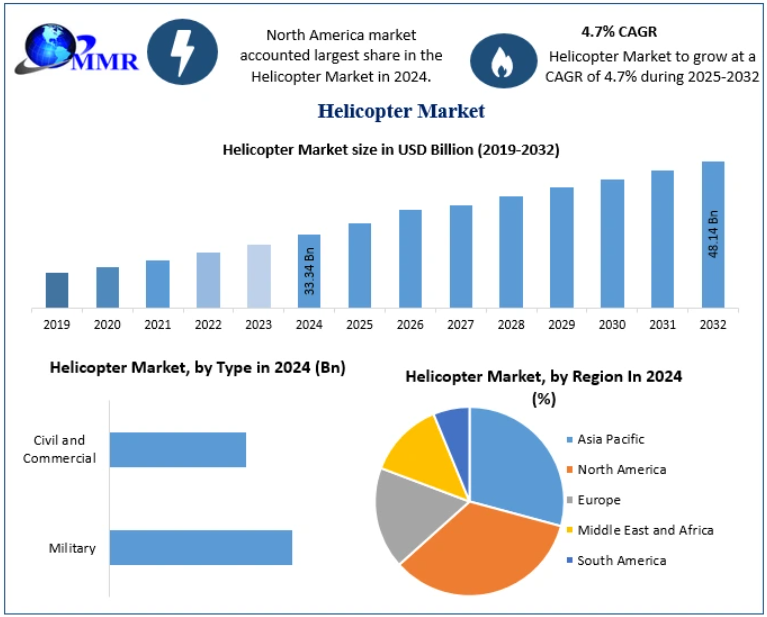

The global Helicopter Market was valued at USD 33.34 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 4.7% from 2025 to 2032, reaching approximately USD 48.14 billion by 2032. The market’s steady expansion reflects sustained demand across emergency services, defense, offshore energy, and premium transportation applications.

Market Overview

The helicopter industry continues to demonstrate resilience despite macroeconomic uncertainty, geopolitical tensions, and lingering supply chain disruptions. Global helicopter deliveries are expected to remain close to the 500-unit annual level, supported by replacement demand, fleet modernization, and rising utilization across civil, commercial, and military sectors.

North America and Europe remain the largest markets for leased and operational helicopters, driven by offshore oil & gas activities, emergency medical services (EMS), and search-and-rescue (SAR) missions. At the same time, Asia-Pacific and South America are emerging as high-potential regions, supported by infrastructure expansion, energy exploration, and growing defense budgets.

Helicopters play a critical role where speed, accessibility, and vertical take-off capability are essential. Their ability to reach remote, rugged, or offshore locations makes them indispensable for emergency response, defense operations, and specialized transport missions.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/15356/

Importance of Helicopters in Emergency and Medical Services

Helicopters are vital assets for air ambulance and medical evacuation (MEDEVAC) services due to their unmatched ability to access isolated and difficult terrains quickly. Rapid aerial transport significantly improves patient survival rates by enabling early medical intervention in trauma and critical care cases.

For instance, rescue helicopters such as the MH-60 Jayhawk, operated by the U.S. Coast Guard in Alaska, perform lifesaving missions in extreme environments like the Bering Sea. These helicopters regularly retrieve distressed crew members from fishing vessels and transport them to medical facilities in record time, demonstrating the essential role of helicopters in emergency response ecosystems.

Airbus Helicopters: Market Leadership in 2024

In 2024, Airbus Helicopters reinforced its leadership position with a strong performance in both orders and deliveries.

- Gross Orders: 410

- Net Orders: 393

- Deliveries: 346 helicopters

- Market Share: 54% of the civil and parapublic segment

Orders were placed by 179 customers across 47 countries, highlighting broad-based global demand. Growth was particularly strong in the light twin and medium twin helicopter categories.

The year also marked significant milestones for Airbus Helicopters, including the first flight of its DisruptiveLab demonstrator, designed to reduce fuel consumption through advanced aerodynamic architecture, and the maiden flight of the NH90 Sea Tiger, developed for anti-submarine warfare operations for the German Navy. Additionally, the Spanish Navy inducted its first H135 helicopters, expanding Airbus’ defense footprint.

Helicopter Market Dynamics

Rising Military Helicopter Deployment

Military helicopters continue to see expanding utilization due to their versatility across troop transport, armed attack, reconnaissance, command-and-control, and combat search-and-rescue missions. Governments worldwide are investing in next-generation rotorcraft to enhance operational readiness and battlefield effectiveness.

For example, Poland announced plans to acquire AW149 military helicopters from Leonardo to strengthen its defense capabilities. Similarly, France’s Armament General Directorate signed a contract with Airbus Helicopters for the development and procurement of the H160M under the Light Joint Helicopter Program, covering deliveries for the army, navy, and air force.

These modernization programs are expected to sustain long-term growth in the military helicopter segment.

Growing Demand for Premium and Customized Helicopters

The transportation segment is witnessing rising interest in luxury and customized helicopters for corporate, private, and charter applications. Helicopters offer unmatched time efficiency, flexible routing, and minimal infrastructure requirements compared to fixed-wing aircraft.

Manufacturers are increasingly introducing high-end models tailored for business and VIP travel. A notable example is the ACH160, a luxury helicopter introduced by Airbus, designed to accommodate up to 10 passengers with premium interiors and advanced avionics. The increasing preference for personalized air mobility solutions is expected to significantly contribute to market expansion during the forecast period.

Key Market Trends

Integration of AI and Automation Technologies

Advanced automation and artificial intelligence are transforming helicopter operations. Modern helicopters are equipped with intelligent sensors, digital flight control systems, and automated diagnostics that enhance precision, safety, and operational efficiency.

Automation reduces pilot workload, minimizes human error, and improves mission execution, particularly in complex environments such as offshore platforms and construction sites. Additionally, helicopters are increasingly favored over ground-based cranes for certain lifting operations due to lower emissions, reduced energy consumption, and greater flexibility.

The adoption of digital health monitoring systems and predictive maintenance technologies is further improving fleet availability and lifecycle management.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/15356/

Market Segmentation Insights

By Type

The civil and commercial segment accounted for approximately 65% of the total market share in 2024 and is expected to remain dominant through 2032. Growth is driven by rising demand for emergency medical services, offshore transport, tourism, and urban mobility solutions.

The military segment is projected to grow steadily as aging fleets are replaced and helicopters are increasingly deployed for disaster relief, border security, and humanitarian missions.

By Weight

In 2024, the lightweight helicopter segment held nearly 55% of the global market share. These helicopters, typically with a maximum take-off weight below 6,000 pounds, are widely used for sightseeing, aerial photography, training, and light cargo transport due to their maneuverability, operational simplicity, and cost efficiency.

Regional Insights

North America

North America led the Helicopter Market in 2024, supported by the world’s largest operational fleet. The United States alone operates approximately 7,000 helicopters, with more than 1,000 dedicated to air ambulance services.

Rising offshore wind energy projects, particularly along the U.S. East Coast, are driving demand for helicopter crew transfer services. Contracts awarded for offshore wind logistics, along with increased oil & gas activity, have significantly boosted helicopter utilization.

Canada also contributes to regional growth, with helicopters widely used for emergency medical services, search and rescue operations, firefighting, and tourism.

Recent Industry Developments

- Vertical Aerospace & Rolls-Royce (2023): Partnership to develop and certify an electric vertical take-off and landing (eVTOL) aircraft for urban air mobility.

- Cicare USA (2023): Certification of the Cicare 8 ultralight helicopter under LTF-ULH regulations.

- Leonardo Helicopters & Collins Aerospace (2023): Collaboration on digital helicopter health and usage monitoring systems to enhance safety and maintenance efficiency.

Competitive Landscape

1. Airbus Helicopter Inc. (France and Germany)

2. AgustaWestland (Italy) (part of Leonardo S.p.A.)

3. Bell Helicopter (United States)

4. Korea Aerospace Industries (KAI) (South Korea)

5. Avicopter (China)

6. PZL Swidnik (Poland) (part of Leonardo S.p.A.)

7. Enstrom Helicopter Corporation (United States)

8. Kaman Aerospace (United States)

9. Sikorsky Aircraft Corporation (United States) (part of Lockheed Martin)

10. Columbia Helicopters (United States)

11. Leonardo S.p.A. (Italy)

12. MD Helicopters Inc. (United States)

13. Boeing Rotorcraft Systems (United States)

14. Jiangxi Changhe Aviation Industry Co., Ltd. (China)

15. Robinson Helicopter Company (United States)

16. Russian Helicopters, JSC (Russia)

Conclusion

The global Helicopter Market is positioned for stable and sustained growth through 2032, driven by expanding emergency services, defense modernization programs, offshore energy projects, and rising demand for premium air mobility solutions. Advancements in automation, AI, and sustainable aviation technologies will further enhance operational efficiency and safety, reinforcing helicopters as mission-critical assets across civil, commercial, and military applications.