The Viewfinder Market has emerged as a critical segment within the global imaging and visual systems industry, driven by rapid advancements in camera technologies, the growing culture of content creation, and expanding applications beyond traditional photography. Viewfinders, once considered a simple optical aid, have evolved into sophisticated electronic and hybrid interfaces that play a decisive role in image framing, exposure control, and real-time visual feedback. As imaging devices become smarter, more compact, and more performance-driven, the role of viewfinders has become increasingly central to both professional and consumer-grade equipment.

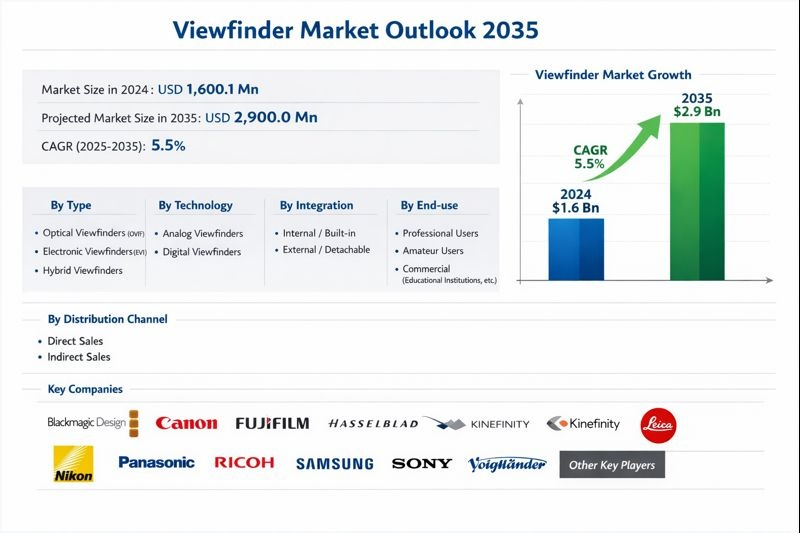

According to industry analysis, the global viewfinder market was valued at USD 1,600.1 Mn in 2024 and is projected to reach USD 2,900.0 Mn by 2035, expanding at a CAGR of 5.5% from 2025 to 2035. This steady growth trajectory reflects sustained demand from professional photographers and videographers, rising adoption of mirrorless camera systems, and growing usage in surveillance, industrial imaging, and emerging digital applications.

Market Overview and Evolution of Viewfinder Technology

A viewfinder serves as the visual interface that allows users to compose and frame an image accurately before capture. Traditionally, viewfinders relied on optical components such as prisms and mirrors to deliver a real-time, unprocessed view of the subject. These optical viewfinders (OVFs) dominated early camera systems due to their simplicity, clarity, and zero power consumption.

However, the last decade has seen a major shift toward electronic viewfinders (EVFs), which use miniature digital displays to project the image captured by the sensor directly to the user’s eye. EVFs enable advanced features such as exposure simulation, focus peaking, histograms, and augmented overlays—capabilities that are not possible with purely optical systems. The introduction of hybrid viewfinders, combining optical and electronic elements, has further expanded user choice by offering flexibility between traditional viewing and digital enhancement.

The technological evolution of viewfinders mirrors the broader transformation of the imaging industry, where digital integration, compact form factors, and intelligent processing have become defining characteristics.

Key Market Drivers Fueling Growth

Rising Popularity of Content Creation and Professional Imaging

One of the most significant drivers of the viewfinder market is the explosive growth of content creation across digital platforms. Social media influencers, professional photographers, filmmakers, vloggers, and independent creators increasingly rely on dedicated imaging equipment to achieve superior visual quality. While smartphones dominate casual photography, serious creators continue to favor interchangeable-lens cameras and professional video systems equipped with advanced viewfinders.

Electronic viewfinders, in particular, are highly valued for their ability to provide real-time exposure previews, color balance adjustments, and focus accuracy. These features streamline workflows and reduce post-processing time, making EVFs indispensable for professionals working under time constraints.

Rising Disposable Incomes and Premium Device Adoption

Growing disposable incomes, especially in emerging economies, are encouraging consumers to invest in premium imaging devices. As buyers move from entry-level cameras to mid-range and high-end systems, demand for advanced viewfinder modules rises correspondingly. Premium cameras often integrate high-resolution OLED or micro-OLED viewfinders with superior brightness, contrast, and refresh rates, driving both unit value and technological complexity.

This trend is particularly evident in Asia Pacific markets, where rising urbanization, digital literacy, and lifestyle aspirations are fueling demand for professional-grade imaging equipment.

Viewfinder Market Segmentation Analysis

By Type: Electronic Viewfinders Lead the Market

Among the different types, electronic viewfinders (EVFs) held the dominant market share of 64.0% in 2024, making them the most widely adopted solution globally. EVFs provide a digital representation of what the camera sensor sees, allowing users to preview exposure, depth of field, and white balance in real time.

Technological improvements in OLED and micro-OLED displays have significantly enhanced EVF performance, offering higher resolutions, faster refresh rates, and improved visibility in challenging lighting conditions. Features such as eye tracking, focus peaking, and real-time data overlays further enhance usability, particularly for professional users.

Optical viewfinders continue to retain relevance among traditional photographers who prefer an unprocessed view, while hybrid viewfinders cater to niche segments that demand operational flexibility.

By Technology: Digital Viewfinders Gain Momentum

The market is broadly divided into analog viewfinders and digital viewfinders. Digital viewfinders are gaining rapid traction due to their compatibility with modern camera architectures and advanced software integration. As imaging systems increasingly rely on sensors and processors, digital viewfinders align more effectively with evolving hardware ecosystems.

Analog viewfinders, while reliable and power-efficient, face limitations in functionality and adaptability, which restrict their growth in advanced imaging applications.

By Integration: Built-in vs. Detachable Systems

Viewfinders are available as internal/built-in components or external/detachable modules. Built-in viewfinders dominate consumer and professional cameras, offering seamless integration and ergonomic convenience. Detachable viewfinders, on the other hand, are increasingly popular in professional video rigs, broadcast cameras, and modular imaging systems where flexibility and customization are essential.

End-use and Distribution Channel Insights

From an end-use perspective, professional users represent the largest demand segment, including photographers, cinematographers, broadcasters, and surveillance operators. Amateur users and commercial institutions such as educational and training centers also contribute significantly to market demand.

In terms of distribution, direct sales channels remain important for high-value professional equipment, while online retailers and specialty stores are gaining prominence due to wider product visibility and competitive pricing. The growth of e-commerce has expanded access to advanced imaging equipment, especially in emerging markets.

Regional Outlook: Asia Pacific at the Forefront

The Asia Pacific region dominated the global viewfinder market in 2024, accounting for 34.0% of total revenue. This leadership is underpinned by strong manufacturing capabilities, a mature electronics supply chain, and the presence of major imaging technology companies in countries such as Japan, China, and South Korea.

From a demand perspective, Asia Pacific exhibits strong consumer engagement with imaging technologies. Rising disposable incomes, a vibrant content creation culture, and widespread adoption of digital devices continue to drive demand for professional and consumer cameras equipped with advanced viewfinders.

Additionally, sustainability considerations are gaining importance in the region. Manufacturers are increasingly investing in energy-efficient display technologies and recyclable materials, aligning product innovation with environmental responsibility.

Competitive Landscape and Key Players

The global viewfinder market is moderately competitive, characterized by the presence of established imaging giants and specialized technology providers. Leading companies include Canon Inc., Sony Corporation, Nikon Corporation, FUJIFILM Corporation, Samsung, Panasonic Connect Co., Ltd., Leica Camera AG, Blackmagic Design Pty. Ltd., Hasselblad, Kinefinity Inc., Ricoh, and Voigtländer GmbH.

These players compete on parameters such as display resolution, brightness, power efficiency, ergonomic design, and integration capabilities. Continuous investment in research and development remains a key strategy, as companies seek to differentiate their offerings through superior performance and user experience.

Recent Developments and Innovation Trends

Innovation remains a defining feature of the viewfinder market. In 2025, several notable product launches highlighted the industry’s technological momentum. Companies introduced compact, lightweight viewfinders with high-resolution micro-OLED displays, improved brightness, and broader compatibility across camera platforms.

Mirrorless camera launches featuring enhanced EVF modes demonstrate how manufacturers are blending retro design aesthetics with modern digital functionality. These developments underscore the market’s dual focus on performance advancement and user-centric design.

Market Challenges and Sustainability Considerations

Despite positive growth prospects, the viewfinder market faces challenges related to production costs, particularly for advanced micro-OLED displays and high-density electronic components. These costs can impact pricing strategies and profitability, especially in price-sensitive markets.

Sustainability is another growing concern. The rapid replacement cycle of imaging devices contributes to electronic waste, prompting manufacturers to explore modular designs, recyclable materials, and extended product lifecycles. Balancing high performance with environmental responsibility will remain a key strategic priority for industry participants.

Future Outlook and Opportunities

Looking ahead to 2035, the viewfinder market is expected to benefit from continued advancements in display technology, sensor integration, and augmented reality features. Emerging applications in drones, automotive imaging, industrial inspection, and smart surveillance systems present new growth avenues beyond traditional photography.

As user expectations evolve, viewfinders will increasingly function as intelligent interfaces rather than passive viewing tools. Companies that successfully combine performance innovation, ergonomic design, cost efficiency, and sustainability will be best positioned to capture future market opportunities.