Medical membranes have become an indispensable component of modern healthcare, quietly enabling critical therapies, diagnostics, and life-saving procedures. From hemodialysis and drug delivery to tissue engineering and artificial organs, these specialized materials play a vital role in improving patient outcomes. As healthcare systems worldwide focus on advanced treatments and long-term disease management, the global medical membrane market is set for robust growth through the end of the decade.

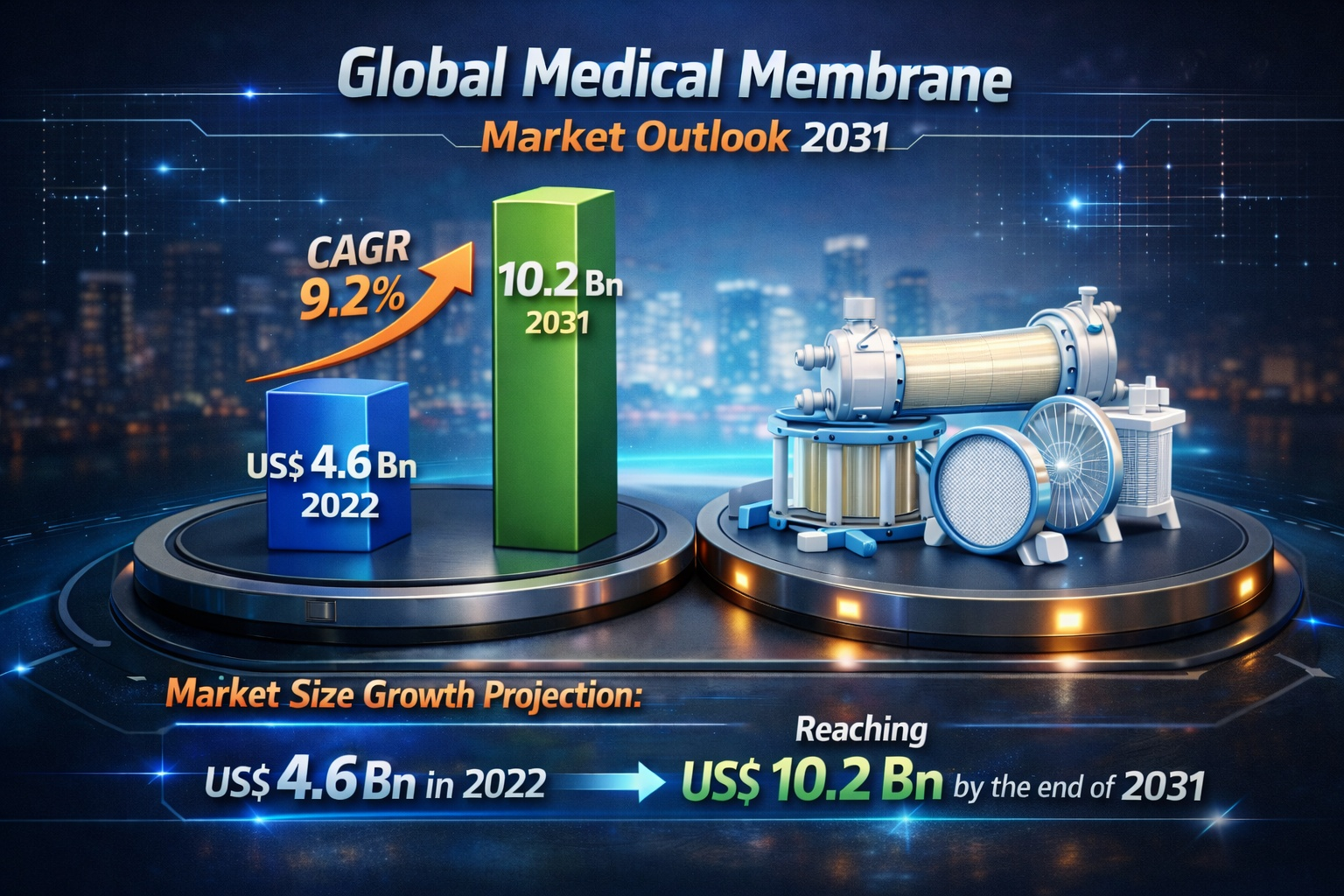

The global medical membrane industry was valued at US$ 4.6 billion in 2022 and is projected to reach US$ 10.2 billion by 2031, expanding at a strong CAGR of 9.2% between 2023 and 2031. This impressive growth trajectory reflects rising demand for advanced medical technologies, increasing prevalence of chronic diseases, and rapid innovation across the pharmaceutical and biotechnology sectors.

What Are Medical Membranes?

Medical membranes are engineered materials designed to perform precise functions such as filtration, separation, protection, and controlled drug release. Common types include hemodialysis membranes, microfiltration and ultrafiltration membranes, reverse osmosis membranes, wound dressing membranes, and drug delivery membranes. These membranes are widely used in applications such as bioprocessing, artificial organs, tissue engineering, minimally invasive surgeries, and diagnostic devices.

Their benefits are substantial—medical membranes help reduce infection risks, enhance localized drug delivery, accelerate tissue repair, and improve healing processes. As a result, they have become integral to both surgical and non-surgical medical procedures.

Key Growth Drivers Shaping the Market

One of the most significant drivers of the medical membrane market is the surge in demand for artificial organs and tissue engineering solutions. Medical membranes are widely used in organ transplantation to promote tissue integration, minimize rejection risks, and support cell growth and differentiation. With the global shortage of donor organs and increasing need for functional tissue substitutes, demand for biocompatible membrane materials continues to rise.

Another major factor fueling market growth is the increasing prevalence of chronic diseases, including diabetes, cardiovascular disorders, cancer, and kidney disease. These conditions often require long-term therapies such as dialysis, drug delivery systems, and continuous diagnostics—areas where medical membranes play a critical role. Lifestyle changes, aging populations, and physical inactivity have further intensified the burden of chronic illnesses worldwide, directly contributing to higher adoption of medical membrane technologies.

Additionally, road accidents and traumatic injuries, which often result in limb loss or severe tissue damage, are driving the need for advanced surgical interventions and organ transplant procedures, further supporting market expansion.

Get Sample PDF Copy: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=48726

Regional Outlook: North America at the Forefront

From a regional perspective, North America dominated the global medical membrane market in 2022. This leadership is driven by a rapidly growing geriatric population, high prevalence of chronic diseases, and access to advanced healthcare infrastructure. In the United States alone, nearly 6 in 10 adults live with at least one chronic disease, creating sustained demand for dialysis, diagnostic devices, and drug delivery systems that rely heavily on medical membranes.

Competitive Landscape and Recent Developments

The medical membrane market is highly competitive, with leading players focusing on product innovation, strategic acquisitions, and portfolio expansion. Companies such as Pall Corporation, Merck KGaA, 3M, Sartorius AG, Asahi Kasei Corporation, Thermo Fisher Scientific, and W. L. Gore & Associates are actively investing in advanced membrane technologies.

Recent developments highlight this trend. In November 2023, Merck KGaA announced plans to acquire Caraway Therapeutics to strengthen its neurological treatment pipeline. Similarly, Sartorius AG’s acquisition of Polyplus in July 2023 underscores the industry’s focus on biologics, cell, and gene therapy production.

Looking Ahead

With strong growth drivers, expanding applications, and continuous technological advancements, the medical membrane market is poised to play a pivotal role in the future of healthcare. As demand for precision medicine, artificial organs, and advanced drug delivery systems accelerates, medical membranes will remain at the heart of innovation—bridging science, technology, and patient care through 2031 and beyond.