Global Smart Fleet Management Market Outlook (2024–2030)

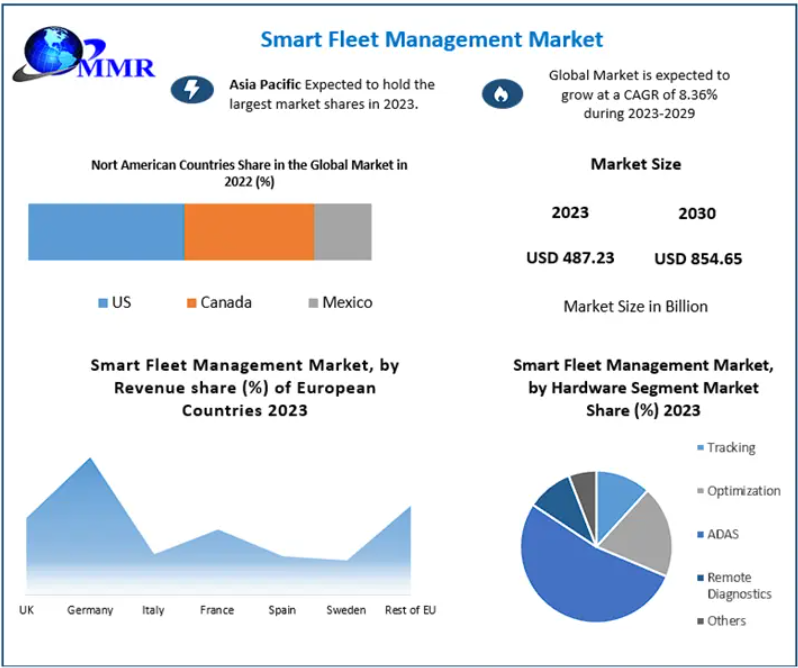

The global Smart Fleet Management Market was valued at USD 487.23 billion in 2023 and is projected to grow at a CAGR of 8.36%, reaching approximately USD 854.65 billion by 2030. This growth is driven by the rising adoption of digital technologies, real-time vehicle monitoring, and connected vehicle solutions, along with increasing demand for operational efficiency, cost reduction, and driver safety across transportation sectors.

Market Overview

Smart fleet management involves the integration of technology to monitor, track, and optimize vehicle fleets, ensuring improved safety, efficiency, and cost-effectiveness. These systems allow fleet operators to manage maintenance schedules, monitor driver performance, optimize routes, and reduce operational expenditures.

Modern fleet management solutions leverage IoT (Internet of Things), GPS, cloud computing, big data analytics, and AI to collect and analyze real-time vehicle data, enabling predictive maintenance and efficient decision-making. With the growing trend of shared mobility services, electric vehicles (EVs), and autonomous transportation, the demand for intelligent fleet management systems continues to rise.

Additionally, marine fleet management is becoming increasingly crucial as 80% of global trade by volume occurs via sea transport, according to UNCTAD. Fleet operators rely on integrated software solutions to enhance operational productivity, reduce operational costs, and maintain competitive advantage.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/3041/

Market Dynamics

Growth Drivers

- Expansion of Shared Mobility Services

The rise of vehicle leasing, ridesharing, subscriptions, and rental services is increasing fleet sizes, particularly in developed markets like the U.S. Fleet operators are replacing older vehicles with electric and connected vehicles, further driving demand for fleet management solutions. - Real-Time Fleet Monitoring

Real-time tracking enables managers to monitor driver behavior, route adherence, and vehicle performance. Cloud-based and AI-powered systems allow for predictive maintenance, fuel optimization, and operational efficiency, propelling market growth. - Integration with ADAS (Advanced Driver Assistance Systems)

ADAS features, such as lane departure warnings, collision avoidance, and adaptive cruise control, enhance safety and performance monitoring. When integrated with fleet management solutions, ADAS provides insights for in-vehicle and external environment monitoring, ensuring optimal fleet operations while improving driver and asset safety. - Government Regulations

Regulatory initiatives, such as the Compliance Safety Accountability (CSA) program in the U.S., mandate monitoring of fleet vehicles and driver behavior. Governments globally encourage fleet operators to adopt vehicle safety technologies and data reporting systems, driving adoption of smart fleet management solutions.

Market Restraints

- Technology Maturity and Substitutes

The smart fleet management market faces challenges from mature technologies and the availability of alternative fleet management solutions. Continuous innovation is required to maintain competitive advantage. - High Initial Costs

Implementing advanced fleet management systems requires significant investment in hardware, sensors, and connectivity infrastructure, which can be a barrier for smaller fleet operators.

Market Segmentation

By Transportation Mode

- Automotive – The largest segment with 65% market share, driven by personal cars, commercial trucks, buses, and ride-sharing fleets. Adoption of IoT, telematics, GPS, and ADAS is high in this sector.

- Rolling Stock – Rail and logistics fleet management solutions.

- Marine – Fleet management solutions for shipping and maritime transport.

By Hardware

- Vehicle Tracking – Real-time GPS-based vehicle monitoring.

- Fleet Optimization – Route planning, fuel management, and predictive maintenance.

- ADAS – Driver assistance and safety integration.

- Remote Diagnostics – Monitoring vehicle health and maintenance needs remotely.

By Connectivity

- Short-Range Communication – Vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications, supporting real-time safety alerts.

- Long-Range Communication – Wide-area network communications for monitoring dispersed fleets.

- Cloud-Based Solutions – Scalable solutions for small to medium-sized fleets, enabling remote monitoring and data security.

By Solution

- Vehicle Tracking

- Fleet Optimization

Regional Insights

- Asia Pacific – Leading the global market due to rapid urbanization, growing adoption of connected vehicles, and increasing fleet sizes in India, China, Japan, South Korea, and Malaysia. Road safety concerns and regulatory mandates are boosting the adoption of ADAS technology.

- North America & Europe – Significant market contributors, driven by technological advancements, electric and autonomous vehicle adoption, and stringent safety regulations. Europe serves as a hub for automotive OEMs integrating advanced fleet technologies.

- Middle East & Africa – Growing investments in commercial fleets and logistics infrastructure.

- South America – Rising demand for fleet optimization solutions across automotive and logistics sectors.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/3041/

Market Competitive Landscape

Leading companies in the smart fleet management market focus on R&D, partnerships, and product innovation to enhance fleet operations. Collaboration between technology providers, automotive OEMs, and research institutions is common.

Notable recent initiatives include:

- Siemens partnered with Volta Trucks in 2022 to develop eMobility infrastructure for fleet electrification.

- Cisco and Mercedes-Benz collaborated in 2023 to create mobile office solutions for vehicles.

- Continental and HERE Technologies teamed with IVECO in 2023 to integrate fuel-saving and safety features for commercial vehicles.

Key Players by Region

North America: HARMAN International, IBM, Cisco, ORBCOMM, Verizon Connect, Trimble, Geotab, Samsara.

Europe: Robert Bosch GmbH, Continental AG, Siemens AG, TomTom, BMW, Trakm8 Limited.

Asia-Pacific: DENSO Corporation, CHAINWAYTSP Co. Ltd, EROAD.

MEA: Mix Telematics.

Market Scope

- Base Year: 2023

- Forecast Period: 2024–2030

- Market Size (2023): USD 487.23 Billion

- Market Size (2030): USD 854.65 Billion

- CAGR (2024–2030): 8.36%

Segments Covered:

- Transportation: Automotive, Rolling Stock, Marine

- Hardware: Tracking, Optimization, ADAS, Remote Diagnostics

- Connectivity: Short-Range, Long-Range, Cloud

- Solutions: Vehicle Tracking, Fleet Optimization

Regions: North America, Europe, Asia Pacific, Middle East & Africa, South America