AI-Powered Personal Finance Management Market: Growth, Trends, and Strategic Outlook

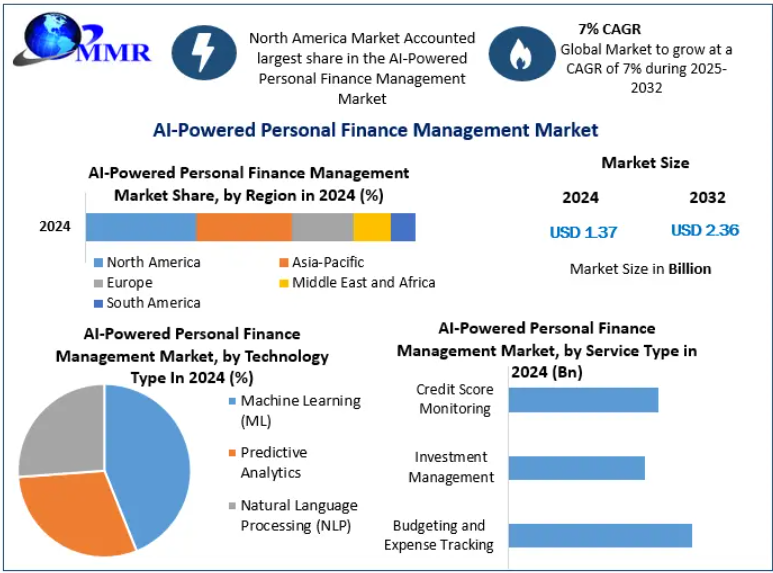

The AI-Powered Personal Finance Management (PFM) Market is gaining strong momentum as consumers increasingly rely on intelligent digital tools to manage their finances efficiently. Valued at USD 1.37 billion in 2024, the market is projected to expand at a CAGR of 7% from 2025 to 2032, reaching approximately USD 2.36 billion by 2032. This growth reflects rising demand for automation, personalization, and data-driven financial decision-making.

Market Overview

AI-powered personal finance management solutions integrate advanced technologies such as machine learning (ML), natural language processing (NLP), predictive analytics, and automation to help individuals and institutions manage income, expenses, investments, and credit profiles. These platforms reduce manual financial tasks, improve operational efficiency, and deliver real-time insights that empower users to make smarter financial decisions.

Automation is a key value driver. AI systems handle repetitive activities such as expense categorization, bill reminders, and budget tracking, allowing users to focus on strategic financial planning. As AI capabilities evolve, platforms are expected to deliver more sophisticated automation features, further streamlining financial operations. The convergence of AI with emerging technologies like blockchain and decentralized finance (DeFi) is also reshaping the PFM landscape by enabling secure, transparent, and intermediary-free financial services.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/222191/

Market Dynamics

Rising Demand for Personalized Financial Solutions

Personalization has emerged as a cornerstone of AI-driven financial management. AI platforms analyze large volumes of user data—including income patterns, spending behavior, financial goals, and risk tolerance—to deliver tailored financial plans. This level of customization was once limited to high-net-worth individuals but is now accessible to a broader consumer base through AI-enabled tools.

Continuous advancements in AI algorithms are enhancing personalization further. Dynamic risk assessment models now adapt in real time based on market conditions, economic indicators, and changes in a user’s financial situation. As a result, users receive more accurate, context-aware recommendations that evolve alongside their financial journeys.

Benefits and Challenges of AI in Personal Finance

AI adoption in personal finance offers significant advantages, including enhanced efficiency, accurate financial forecasting, and highly personalized insights. However, challenges such as data security risks, lack of human empathy, and overreliance on automated advice remain key concerns.

To maximize benefits, platforms are increasingly adopting hybrid models that combine AI efficiency with human financial expertise. Strengthening financial literacy and encouraging users to understand AI-driven insights also helps mitigate overdependence on automation.

Integration of Emerging Technologies

The integration of AI with blockchain and DeFi is opening new avenues for innovation in personal finance management. Blockchain enhances data security through decentralized and cryptographic frameworks, reducing risks of fraud and unauthorized access. DeFi, meanwhile, enables users to participate directly in financial activities such as lending, borrowing, and trading without traditional intermediaries.

As these technologies mature, their integration with AI is expected to become more seamless, leading to wider adoption. Growing financial literacy around AI and decentralized finance further supports this trend, encouraging users to embrace advanced, transparent, and efficient financial solutions.

Data Privacy and Security Concerns

Handling sensitive financial data places strong emphasis on privacy and cybersecurity. Ensuring robust encryption, regulatory compliance, and protection against data breaches is critical for market growth. Multi-factor authentication (MFA) has emerged as a key security feature, enhancing user trust and platform credibility.

User-friendly and customizable MFA options—such as biometrics or one-time codes—improve adoption by balancing security with convenience. Platforms that prioritize data protection are better positioned to gain long-term consumer confidence.

Regional Insights

North America dominated the AI-powered personal finance management market in 2024, driven by advanced technological infrastructure, high smartphone penetration, and a mature fintech ecosystem. The United States, particularly hubs such as Silicon Valley and New York, has been at the forefront of fintech innovation.

The COVID-19 pandemic significantly accelerated digital finance adoption, with digital banking usage surging as consumers avoided physical bank visits. North America’s strong data connectivity enables AI platforms to process vast financial datasets in real time, delivering accurate and actionable insights. Continued investment in R&D is expected to reinforce the region’s leadership, particularly in refining machine learning algorithms for deeper personalization.

Segment Analysis

By technology, Machine Learning (ML) holds the largest share of the market and is expected to maintain dominance throughout the forecast period. ML-driven predictive analytics enables platforms to anticipate financial trends, optimize budgeting strategies, and provide forward-looking investment insights.

The integration of ML with complementary technologies such as blockchain enhances both prediction accuracy and data security. Ongoing improvements in algorithm sophistication, dataset expansion, and modeling techniques are driving superior user experiences and reinforcing ML's central role in market growth.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/222191/

Competitive Landscape

The competitive environment is characterized by continuous innovation in ML, predictive analytics, and NLP capabilities. Companies are differentiating themselves through intuitive user interfaces, seamless platform integration, and advanced automation features. Compatibility with banking systems, investment platforms, and payment solutions further enhances platform usability and market competitiveness.

Strategic acquisitions have played a key role in market expansion. Major players such as Intuit, Betterment, and Robinhood have strengthened their portfolios through targeted acquisitions, enabling broader service offerings and geographic reach.

Market Scope and Outlook

The AI-powered personal finance management market spans multiple segments, including budgeting and expense tracking, investment management, and credit score monitoring, delivered via mobile apps and web-based platforms. While individual consumers remain the primary end-users, financial institutions are increasingly adopting AI-driven PFM solutions to enhance customer engagement.

With rising demand for intelligent, secure, and personalized financial tools, the market is poised for steady growth through 2032. Continued advancements in AI, coupled with deeper integration of blockchain and DeFi technologies, are expected to redefine how consumers manage their personal finances in the digital era.