Gunshot Detection System Market to Surge to USD 3.11 Billion by 2032 Amid Rising Urban Violence

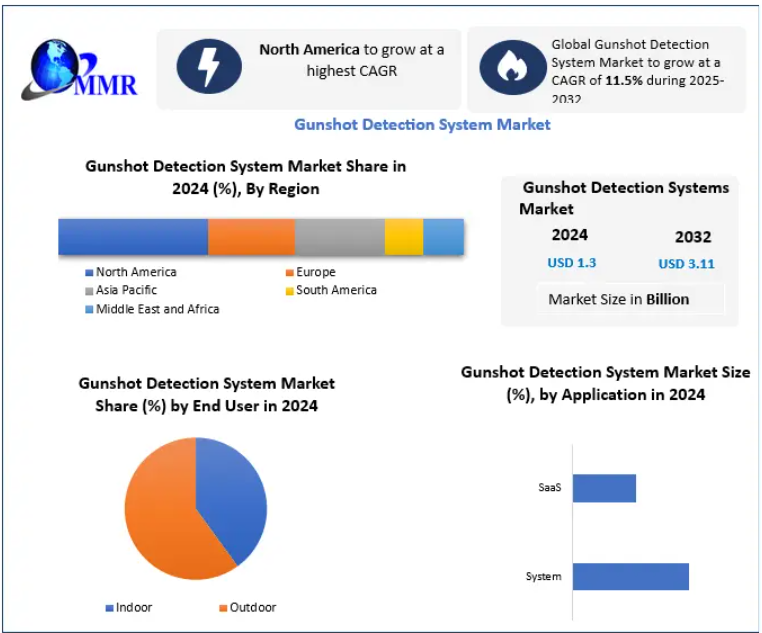

The Global Gunshot Detection System (GDS) Market is witnessing rapid growth driven by increasing public safety concerns, rising urban violence, and the need for real-time situational awareness. Valued at USD 1.3 billion in 2024, the market is projected to grow at a CAGR of 11.5% from 2025 to 2032, reaching nearly USD 3.11 billion by 2032.

Market Overview

Gunshot detection systems utilize acoustic, optical, and sensor-based technologies to detect, locate, and alert law enforcement about firearm discharges in real time. By enabling faster response times and enhancing situational awareness, these systems play a pivotal role in increasing public safety in schools, commercial areas, military zones, and urban centers.

The demand for GDS is fueled by several factors: rising gun violence, the expansion of smart city initiatives, growing defense modernization programs, and the need for real-time intelligence in high-risk environments. These systems integrate IoT, AI, GPS, and cloud-based platforms to provide accurate detection and efficient monitoring.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/29340/

Market Dynamics

Drivers

- Increasing Gun Violence in Educational Institutions: In the U.S., shootings in schools, colleges, and universities account for over 22% of all active shooting incidents, highlighting the urgent need for GDS in educational environments.

- Smart City Initiatives: Cities are increasingly integrating gunshot detection into urban surveillance networks, enabling rapid alerts and enhancing public safety.

- Technological Advancements: AI-powered acoustic analysis, cloud platforms, and IoT-enabled sensors reduce installation and maintenance costs while improving detection accuracy.

Challenges

- High Installation and Maintenance Costs: Deploying multiple sensors over large areas is expensive, especially in urban environments.

- Impact of COVID-19: The pandemic temporarily slowed commercial GDS installations due to travel restrictions and reduced government and private investment in security infrastructure.

Segment Analysis

By Product

- Commercial: Driven by growing adoption in smart cities, educational institutions, and corporate facilities.

- Defense: Deployed to secure military bases, armored vehicles, and border areas, offering real-time data for counteroffensive operations.

By Type

- Fixed Installation: Dominates the market due to wide adoption in urban infrastructure, airports, and public areas for continuous 24/7 monitoring.

- Vehicle-Mounted: Primarily used by national defense forces for mobile surveillance.

- Soldier-Mounted: Provides tactical advantages in combat and field operations.

By Application

- System-Based: On-premise solutions integrated into city or campus security networks.

- SaaS-Based: Cloud-managed gunshot detection platforms providing scalable, cost-efficient monitoring.

By End-Users

- Indoor: Universities, corporate offices, financial institutions, and commercial complexes.

- Outdoor: Urban neighborhoods, streets, public parks, and defense perimeters.

Regional Insights

North America leads the global market, propelled by rising firearm-related incidents, high defense budgets, and government support. Major U.S. cities like New York, Chicago, Los Angeles, and Detroit are deploying acoustic gunshot detection systems to enhance public safety.

Europe and Asia-Pacific are also witnessing steady growth, supported by military modernization and smart city projects. Meanwhile, the Middle East & Africa and South America are emerging markets with increasing investments in urban security and border defense.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/29340/

Competitive Landscape

The market is highly competitive, dominated by key players leveraging technology, AI, and strategic partnerships:

- ShotSpotter Inc. (US): Leading urban civilian segment with real-time cloud-based acoustic detection.

- Raytheon Technologies (US): Provides military-grade vehicle and soldier-mounted systems.

- Safran Electronics & Defense (France/US): Focused on border security and military operations with high directional accuracy sensors.

- Rheinmetall AG (Germany): Specializes in vehicle-mounted systems for defense sectors.

- AmberBox Gunshot Detection (US): Offers integrated indoor detection for campuses and commercial facilities.

Other notable players include Thales Group, ASELSAN, Louroe Electronics, Hensoldt Sensors, and Condor Non-Lethal Technologies, highlighting a global distribution across defense and commercial sectors.

Market Trends and Key Developments

- AI Integration: AI and machine learning enhance detection speed and accuracy while minimizing human intervention.

- Smart City Deployments: GDS is increasingly embedded in city surveillance grids.

- Real-Time Alert Systems: Rapid alert technologies ensure faster law enforcement response.

Recent Developments:

- In March 2024, Emerson Electric launched an upgraded DeltaV™ SIS with enhanced cybersecurity.

- In January 2025, AmberBox integrated smart indoor detection with fire and security alarm systems.

- In March 2025, Rheinmetall AG secured a military supply contract in Eastern Europe.

- In May 2024, ShotSpotter expanded its acoustic detection network to 10 additional U.S. cities.

Future Outlook

The Gunshot Detection System Market is set for significant growth through 2032, driven by rising urban violence, expansion of smart cities, and continuous technological innovations in AI, IoT, and cloud platforms. Fixed installations are expected to maintain market dominance due to their wide applicability and high accuracy, while defense and commercial sectors increasingly invest in advanced solutions.

As governments and private institutions prioritize public safety and rapid response technologies, the GDS market is poised to evolve into an essential component of modern urban infrastructure and defense security planning.