Business Jet Market: Trends, Drivers, and Growth Opportunities 2025–2032

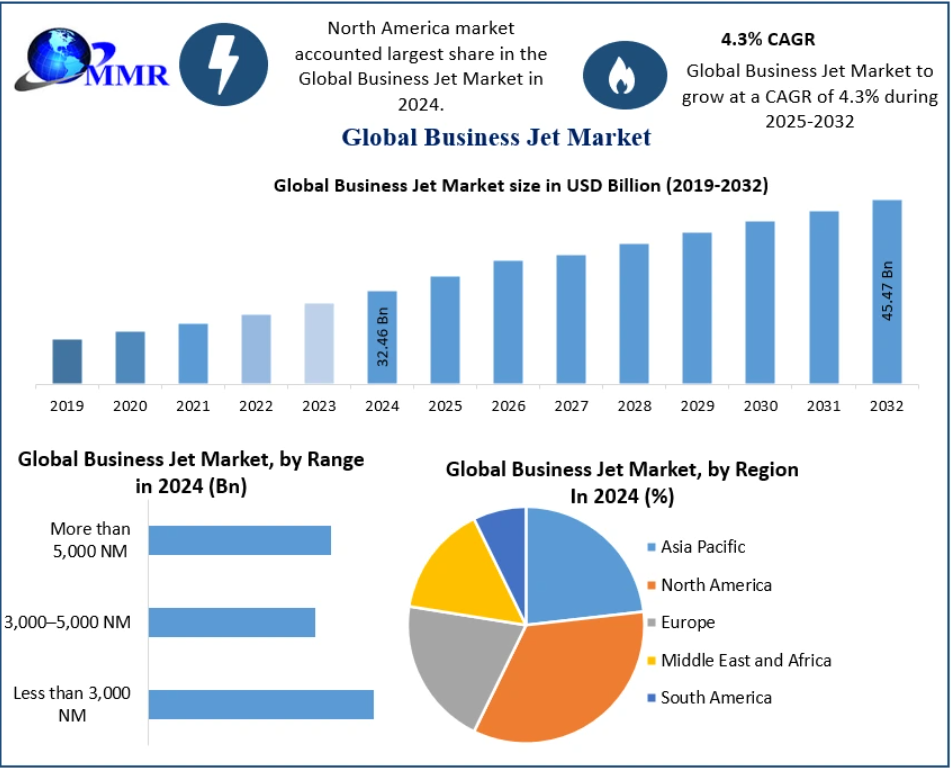

The Business Jet Market was valued at USD 32.46 Billion in 2024 and is projected to reach nearly USD 45.47 Billion by 2032, growing at a CAGR of 4.3% . This growth is fueled by increasing corporate demand for private aviation, technological innovations, and rising income levels among high-net-worth individuals seeking luxury and convenience in air travel.

Overview of the Business Jet Market

Business jets are specialized aircraft designed for private, executive, and corporate travel. They combine comfort, speed, and efficiency, offering tailored solutions for executives, high-net-worth individuals, and corporate operations. The market is closely tied to economic cycles—during periods of economic growth, investments in private aviation rise, reflecting corporate expansion and rising global business activity.

Technological advancements in aircraft design, engine efficiency, and avionics have transformed business jets into eco-friendly, high-performance machines. Modern jets now feature advanced connectivity, entertainment systems, and safety measures, addressing the evolving demands of luxury air travel.

The market also sees growing adoption in emerging regions such as Asia-Pacific, Latin America, and the Middle East, supported by expanding airport infrastructure and an increasing number of affluent travelers.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/115116/

Market Dynamics

Drivers

Airport Infrastructure Development

The growth of airport infrastructure is a major driver of the business jet market. Modern airports with expanded runways, taxiways, and specialized FBOs (Fixed Base Operators) enhance accessibility for business jets, including larger aircraft. Improved terminal facilities with VIP lounges, expedited security, and premium handling services attract high-net-worth travelers.

For example:

- United States: ~5,146 airports, ~1 airport per 60,000 people

- India: 251 airports, ~1 airport per 4.6 million people

- China: 413 airports, ~1 airport per 3.2 million people

Enhanced infrastructure not only facilitates efficient take-offs and landings but also supports flexible operations, encouraging more businesses to invest in private aviation.

Restraints

Regulatory Restrictions

Strict regulations related to safety, airspace management, environmental compliance, and certification processes can limit market growth. Businesses face challenges such as:

- Compliance with emissions standards and noise abatement procedures

- Airport slot restrictions and airspace congestion

- Rigorous safety regulations and operational procedures

These factors increase operational costs, lengthen certification timelines, and influence market competitiveness.

Opportunities

Product Innovation

Continuous R&D and technological innovation present significant growth opportunities. Key innovations include:

- Advanced propulsion systems for fuel efficiency

- Fly-by-wire and autonomous flight controls

- Sustainable aviation technologies like hybrid-electric and hydrogen propulsion

- Luxury customization with tailored interiors and premium amenities

Such innovations appeal to luxury customers and environmentally conscious operators, creating new market segments.

Market Segmentation

By Aircraft Type

- Large Jets: Dominated the market in 2024 due to spacious cabins, long-range capabilities, and advanced amenities. Ideal for corporate travel and executive retreats.

- Mid-Sized Jets: Offer balance between range, cost, and passenger capacity.

- Light Jets: Preferred for shorter distances and cost-sensitive buyers.

- Airline Jets: Used for private charter operations by business jet operators.

By Range

- Less than 3,000 NM

- 3,000–5,000 NM

- More than 5,000 NM

By End-Use

- Private Owners : High-net-worth individuals seeking personalized luxury travel

- Operators : Corporate and charter service providers

By Point of Sale

- OEM (Original Equipment Manufacturer)

- Aftermarket : Upgrades, modifications, and refurbishments

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/115116/

Regional Insights

- North America: Dominates the market due to strong economic activity, high net-worth population, advanced airport infrastructure, and leading aircraft manufacturers like Gulfstream, Bombardier, and Textron Aviation.

- Europe: Key players include Dassault Aviation, Airbus Group, and Pilatus Flugzeugwerke. Regulatory frameworks are stricter, influencing aircraft design and operational strategies.

- Asia-Pacific: Growth driven by emerging markets, increasing luxury travel, and developing airport networks.

- Middle East & Africa: Rising investment in corporate aviation and luxury travel fuels demand for business jets.

Competitive Landscape

Major companies in the business jet market include:

- North America: General Dynamics, Textron, Boeing, Stratos Aircraft, Lockheed Martin

- Europe: Dassault Aviation, Piaggio Aero Industries, Airbus Group, Lilium

- Asia-Pacific: China Aviation Technology Industry

- Middle East & Africa: Sukhoi Civil Aircraft, Urban Aeronotics

These companies focus on innovation, R&D, and customer customization to maintain competitive advantage.

Conclusion

The Business Jet Market is poised for steady growth from 2025 to 2032, driven by airport infrastructure development, product innovation, and rising demand for luxury and private air travel. While regulatory restrictions present challenges, opportunities in sustainability, long-range efficiency, and high-end customization offer a clear path for market expansion.

As companies invest in cutting-edge technology and emerging markets embracing corporate aviation, the business jet sector is expected to remain resilient and innovative in the coming decade.