3D Printing Automotive Market Overview

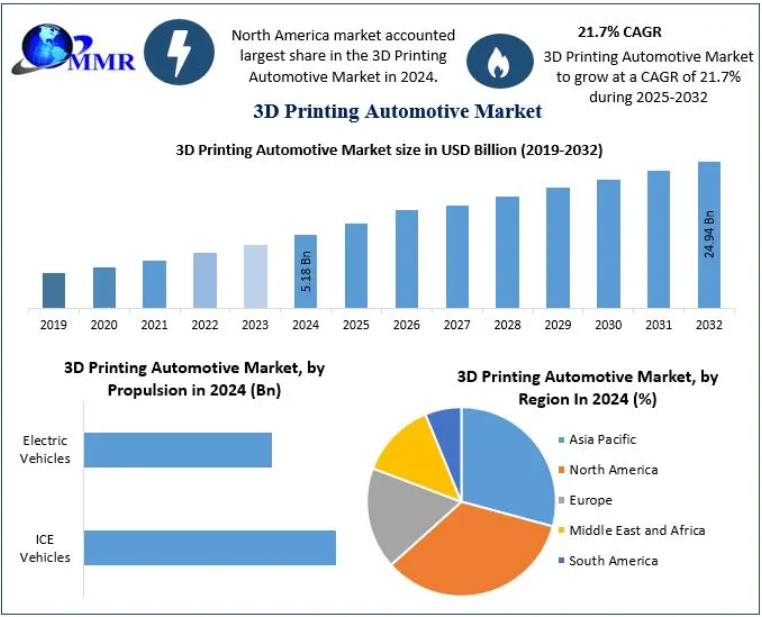

The global 3D Printing Automotive Market is undergoing rapid transformation as automotive manufacturers increasingly adopt additive manufacturing technologies to improve efficiency, reduce costs, and accelerate innovation. Valued at USD 5.18 billion in 2024, the market is projected to reach USD 24.94 billion by 2032, expanding at a strong CAGR of 21.7% during the forecast period. The growing integration of 3D printing across automotive design, prototyping, and production processes is reshaping traditional manufacturing value chains.

3D printing enables automakers to design, test, and manufacture complex components with greater precision and shorter lead times. The technology supports lightweight structures, customization, and faster design iterations, making it a critical tool in modern vehicle development—especially for electric vehicles and advanced mobility solutions.

Market Scope and Research Approach

The market study provides an in-depth analysis of the 3D Printing Automotive Market across key segments such as application, technology, propulsion type, and region. It evaluates emerging trends, growth drivers, restraints, opportunities, and competitive dynamics shaping the industry.

The research methodology combines primary and secondary data sources using a bottom-up estimation approach. Secondary research includes analysis of company annual reports, investor presentations, government publications, trade associations, and industry databases. Primary research involves interviews with OEMs, material suppliers, technology providers, and industry experts across North America, Europe, Asia-Pacific, and other regions.

To know about the Research Methodology :-Request Free Sample Report@https://www.maximizemarketresearch.com/request-sample/9760/

Market Dynamics

OEM Investments Transform Automotive Manufacturing

Automotive OEMs are increasingly investing in 3D printing technologies to streamline manufacturing workflows and reduce time-to-market. Additive manufacturing allows for rapid prototyping, tooling optimization, and low-volume production without extensive tooling costs. Although initial implementation can be capital-intensive, long-term benefits such as reduced waste, lower inventory requirements, and improved design flexibility are driving adoption.

Major industry players continue to expand their R&D investments to enhance printer performance, material quality, and production scalability. Technological advancements over the past two decades have enabled 3D printing to move beyond prototyping toward direct digital manufacturing of functional automotive components.

Technological and Cost Barriers

Despite its advantages, 3D printing still faces challenges that limit large-scale automotive adoption. Conventional manufacturing remains more suitable for high-volume production due to speed and cost efficiency. Current 3D printers have limitations in part size, material compatibility, and production speed.

High costs associated with industrial-grade printers and metal powders also act as barriers. Powder production inefficiencies and inconsistent particle sizes further increase material costs. However, ongoing innovations aimed at improving powder yield rates and declining printer prices are expected to reduce overall costs in the coming years.

Expanding Opportunities Across Adjacent Industries

The evolution of 3D printing from prototyping to full-scale manufacturing is unlocking opportunities across industries such as healthcare, aerospace, and consumer goods. In automotive applications, additive manufacturing enables customization, lightweight designs, and complex geometries that are difficult to achieve with traditional methods. These capabilities position 3D printing as a long-term growth engine for next-generation vehicle platforms.

Market Segment Analysis

By Application

The Prototyping and Tooling segment holds the largest share of the automotive 3D printing market. Manufacturers rely on additive manufacturing to quickly produce prototypes, validate designs, and test components at significantly lower costs. The ability to make real-time design changes, reduce material waste, and shorten development cycles continues to drive segment growth.

By Technology

Stereolithography (SLA) dominates the technology landscape due to its high accuracy, smooth surface finish, and suitability for complex automotive components. SLA is widely used for producing functional prototypes, interior parts, and design validation models. Its compatibility with advanced resins further strengthens its adoption across automotive R&D and low-volume production.

Other technologies such as Selective Laser Sintering (SLS), Fused Deposition Modeling (FDM), and Electron Beam Melting (EBM) are also gaining traction for specialized automotive applications.

By Propulsion Type

Both ICE vehicles and electric vehicles (EVs) contribute to market growth. However, EV manufacturers are increasingly leveraging 3D printing to develop lightweight components, battery housings, and customized interior parts, accelerating innovation in electric mobility.

To know about the Research Methodology :-Request Free Sample Report@https://www.maximizemarketresearch.com/request-sample/9760/

Regional Insights

North America holds the largest share of the automotive 3D printing market, supported by advanced manufacturing infrastructure, strong R&D investment, and the presence of numerous automotive OEMs and technology providers. The United States leads the region due to high demand for both conventional and electric vehicles and extensive use of additive manufacturing in automotive development.

Europe represents the fastest-growing regional market, driven by strong adoption of 3D printing for automotive research, prototyping, and tooling. European automakers increasingly use additive manufacturing to reduce costs, improve sustainability, and accelerate innovation.

The Asia-Pacific region is emerging as a high-growth market due to expanding automotive production, rising EV adoption, and increasing investments in advanced manufacturing technologies across countries such as China, India, Japan, and South Korea.

Competitive Landscape

The 3D Printing Automotive Market is moderately consolidated, with several globally established players dominating the competitive landscape. Leading companies focus on product innovation, technological advancement, strategic partnerships, and geographic expansion to strengthen their market position.

Key players include Stratasys, 3D Systems, EOS, HP, Materialise, Renishaw, and Arcam AB, among others. These companies continue to invest in next-generation printers, materials, and software solutions tailored for automotive applications.

Conclusion

The 3D Printing Automotive Market is set for rapid expansion as automotive manufacturers increasingly embrace additive manufacturing to enhance efficiency, reduce costs, and enable innovation. While challenges related to cost and scalability persist, continuous advancements in materials, printer technology, and manufacturing processes are expected to overcome these barriers. With strong OEM investments and growing adoption across electric and conventional vehicles, 3D printing is poised to become a cornerstone of future automotive manufacturing.